While central banks could still make some final tweaks, most market participants now believe that we are at (or inches away from) the top when it comes to US and European rates. What is most important for investors now, is the shape of the peak we are arriving at. Central banks have made it clear that we can set aside any imagery of a Toblerone-style jagged peak, steep on both sides. The summit is more likely to resemble South Africa’s Table Mountain: a steep incline in rates, only for them to remain steady at high altitudes until policymakers are certain that inflation risks have abated. A protracted period of higher rates will weigh on growth but, at the same time, promises new income opportunities in portfolios.

Europe

As Dutch ECB Governor Klaas Knot put it, the ECB has reached the “finessing” phase of the hiking cycle. Since summer 2022, the central bank has raised rates 10 times, bringing the deposit rate to an all-time high of 4%. Any further hikes will be a hard-sell (absent an unforeseen shock), given the deteriorating macro picture. Going by PMI data, the European services sector has now joined manufacturing in contraction, and the economy is skirting recession. Germany, the bloc’s traditional growth engine, is facing a cyclical downturn, while being confronted by long-running structural issues that had bubbled under the surface until the war in Ukraine. Despite the ailing growth outlook, euro zone inflation and wage growth are still too high, and the labour market has remained exceedingly strong. While no uptick in unemployment seems like a welcome development at first glance, labour hoarding is weighing on productivity (the ECB expects the latter to decline by 0.2% in 2023), and could reinforce a wage-price spiral. At the same time, production cuts and renewed demand from China, have pushed crude prices north of USD 90 per barrel. These factors amplify the stagflation risk that already clouded the euro zone outlook and galvanise the case for postponing rate cuts. As Governor Villeroy has said, “keeping borrowing costs high for a sufficiently long period is now more important than raising rates significantly again,” while Bundesbank President Nagel opined that “it would be wrong to speculate that an interest-rate peak will soon be followed by cuts.”

US

In the US, the Fed’s sequence of 11 hikes appears to have blown out the inflationary fire. However, certain embers are still glowing hot (especially in the services sector, where PMI data shows that companies have been raising prices at a faster pace amid still-firm demand).

Ultimately, our best guess is that core inflation will continue heading in the right direction: credit conditions are tight, pent-up savings will be depleted this quarter according to San Francisco Fed estimates, the labour market is gradually weakening, and student loan repayments are set to re-start in October for millions of Americans (expected to create a 0.6pp drag on monthly PCE spending). These factors suggest demand will start to soften, ultimately aiding the economic “cooling” process (Fed models suggest the bulk of inflation is now demand-driven rather than supply-driven).

However, US households’ propensity to consume has already surprised economists this year and it is difficult to estimate exactly how long their stamina will persist (especially with Thanksgiving, Black Friday and Christmas in the pipeline). Ongoing economic resilience has led the Fed to keep one more precautionary 25bp hike for this year on its dot plot*. Thereafter, policy rates are expected to remain at "restrictive levels" for a prolonged period. Indeed, the projections for 2026 showed the median dot at 2.9%. That’s above what the Fed considers the “neutral” rate (considered to be 2.5%) that is neither stimulative nor restrictive for growth.

Investment strategy

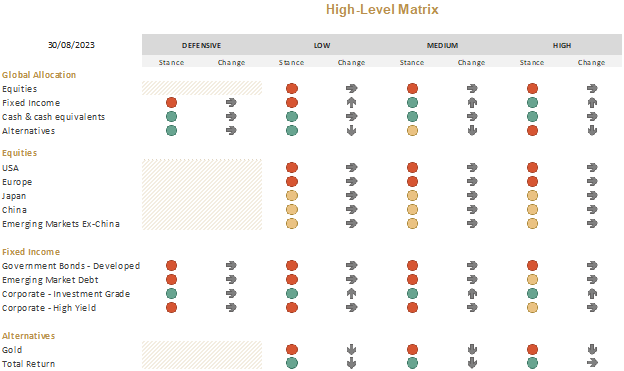

A protracted period of higher rates will take a toll on growth, and we maintain a cautious approach to portfolio construction and an underweight stance on risk assets.

August’s lacklustre market performance implies that the 2023 equity rally is beginning to falter as markets, previously starry-eyed about the future of AI, shift their gaze back to underlying economic fundamentals. Even positive earnings surprises did little to push up prices, while the mildest of disappointments were punished.

In this context, the hedge we put in place in August (covering 1/3 of our US equity exposure and 1/3 of our European equity exposure) has proved beneficial. We are keeping it in place for now, as we seek a degree of protection, believing that there could be more downside risk ahead. Regionally, our largest underweight is to Europe. We are slightly underweight on US equities, and neutral on Japan, Emerging Markets and China. Style-wise, we emphasise quality and a neutral stance on growth versus value.

Consumption has been the driving force behind surprising economic strength, and consumer-related sectors contributed the most to global earnings surprises during the Q2 reporting season. On a tactical basis, we had two preferred sectors through the summer, both focusing on this theme: consumer staples and consumer discretionary. Should we start to see signs of waning demand, we will adjust accordingly.

With the bulk of the climb in rates now behind us, the view up here is an attractive one for fixed income investors, with yields at quite handsome levels. This month, we continued our mission to capture income opportunities by further reducing gold (a non-yielding asset) and total return, and using the proceeds to top up on investment grade credit, this time in the form of floating-rate notes which provide a slightly higher yield than money market funds.

We are constructive on Govies over the longer term (as they should deliver protection in an economic downturn), and monitor attractive entry points to build up our positioning.

We remain underweight on high yield. While the segment has performed quite well recently, we do believe that tighter monetary policy will ultimately lead to higher spreads and that downside risks outweigh upside potential. Up here at (or close to) peak rates, credit (the corporate world’s oxygen) is less abundant. Lower quality companies are likely to be the first to succumb to altitude pressure.

*A chart updated quarterly that records each Fed official's projection for the federal funds rate at the end of each calendar year

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 15, 2025

Weekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...