August 28, 2024

BILBoardBILBoard September 2024 – The stars align for September rate cuts

August brought sky gazers a rare blue supermoon; the next won’t occur until 2037. It also brought what will hopefully prove to be a once-in-a-blue-moon market selloff, amid a perfect storm of catalysts. But while the skies darkened over markets, it became increasingly clear that the stars were aligning for September rate cuts from both the Fed and the ECB.

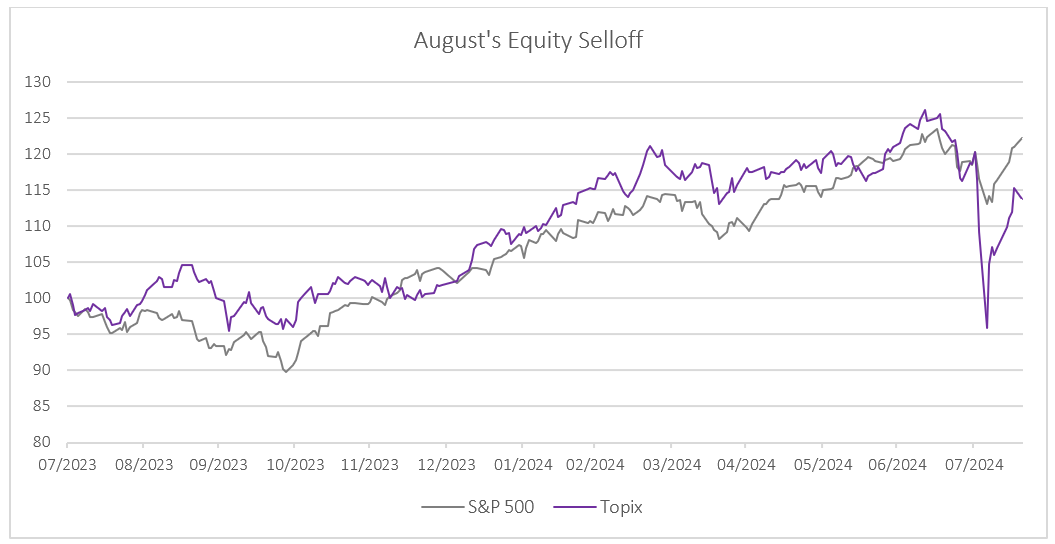

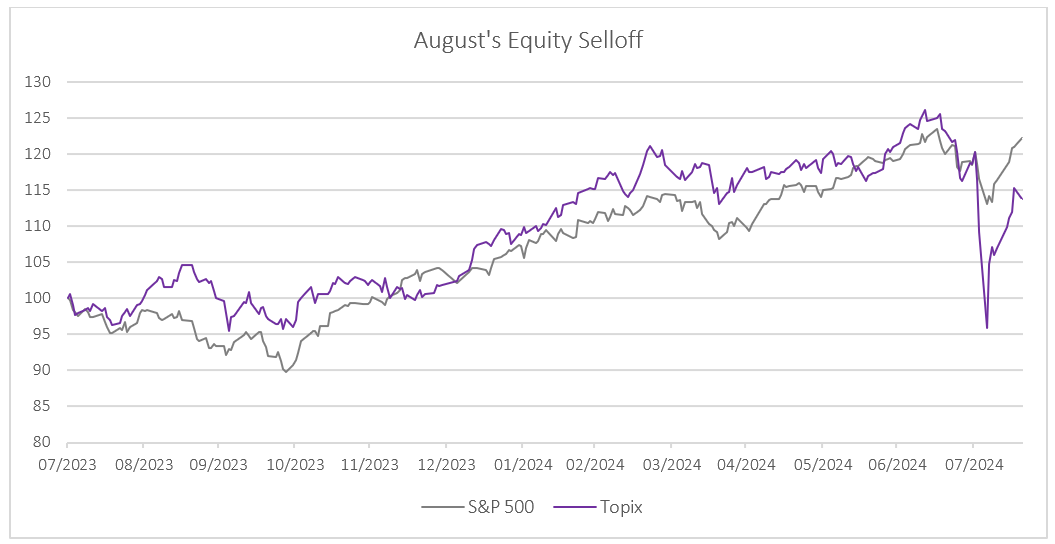

August began with a bang after the Bank of Japan raised rates with a particularly hawkish tone. It sent the Japanese yen skyward, and Japanese equities cratered. However, the impact of the currency appreciation had a very wide orbit as it led to the unwinding of countless global investment strategies based on the Yen carry trade [1]. Simultaneously, a few weak data points lathered up fears that the US economy could be heading for recession, while earnings releases led investors to question how and when companies will monetise huge investments in AI. Thin liquidity, typical of the summer months, exacerbated the downside moves. [2]

Source: Bloomberg, BIL as of 20/8. Normalised to 100

Markets subsequently reversed course after the correction, but we do expect volatility to persist in the months ahead. For its part, the Bank of Japan has reaffirmed its commitment to raising rates, despite acknowledging that “markets at home and abroad remain unstable”.

THE US

Looking at the macro picture in the US, we maintain our base case for slowing growth through the second half of the year, but not a contraction. The labour market is cooling, but overall an unemployment rate of 4.3% is manageable, especially if we consider the recent uptick in the supply of workers. On the corporate side, the impending Presidential election is weighing on confidence: some 40% of big-ticket projects under the IRA and the CHIPS Act have been halted by companies as they await better visibility on the policy pathway. Symptomatic of this, the manufacturing PMI recently declined below the crucial 50 mark. The silver lining in the data is that the services sector is holding up, while meaningful progress has been made on the inflation front, with the headline CPI falling for four consecutive months.

When we wrote the previous BILBoard in mid-July, markets were expecting two Fed rate cuts this year. Traders are now pricing in three to four which we think is a bit too optimistic. We do, however, subscribe to the view that the Fed’s cutting cycle will commence in September, giving the US economy a good chance of achieving a coveted soft landing.

EUROPE

In the Eurozone, PMIs brightened in August but that was largely due to a fleeting boost to the French services sector from the Olympics. Other sentiment indicators such as the ZEW and the German IFO suggest that our base case of meagre growth faces more snakes than ladders. The manufacturing sector remains in a black hole, with new orders continuing to trend down. A continued downturn in industry is causing strong heterogeneity across countries, with Germany still being the weakest link.

While growth data seems to warrant another rate cut, the spanner in the works is that euro area inflation is proving to be quite sticky. This is largely due to the labour-intensive services sector, where staff costs are pushing up output prices. Reassuringly, pay growth appears to be peaking, with negotiated wages at 3.6% YoY in Q2 (the slowest pace since Q4 2022). The minutes of the ECB’s July policy meeting revealed that officials have an “open mind” with regards to cutting rates in September, and the markets now see another 25bp reduction essentially as a “done deal”.

Looking at broader Europe, an upturn in UK PMIs suggests the outlook is brighter over the Channel. The Flash Manufacturing PMI for August rose to 52.5, with UK factory activity now running at its fastest pace in over two years. The Services equivalent rose to 53.3, driven by greater business and consumer spending. Data from Switzerland has also been encouraging. Consumer confidence has hit its highest level since June 2022, and industrial production surged in Q2 with the country benefitting from a relatively low exposure to China.

CHINA

The situation in China continues to be challenging. A series of disappointing indicators has dulled expectations for the country’s economic performance for the rest of 2024. Central bank data shows that new bank loans plunged to a 15-year low in July, while other key gauges showed export growth slowed and factory activity slumped as manufacturers grapple with tepid domestic demand. Broad-brush stimulus from Beijing is not forthcoming and trade negotiations with the EU have soured (e.g., Beijing has launched investigation into imported dairy products).

Investment Strategy

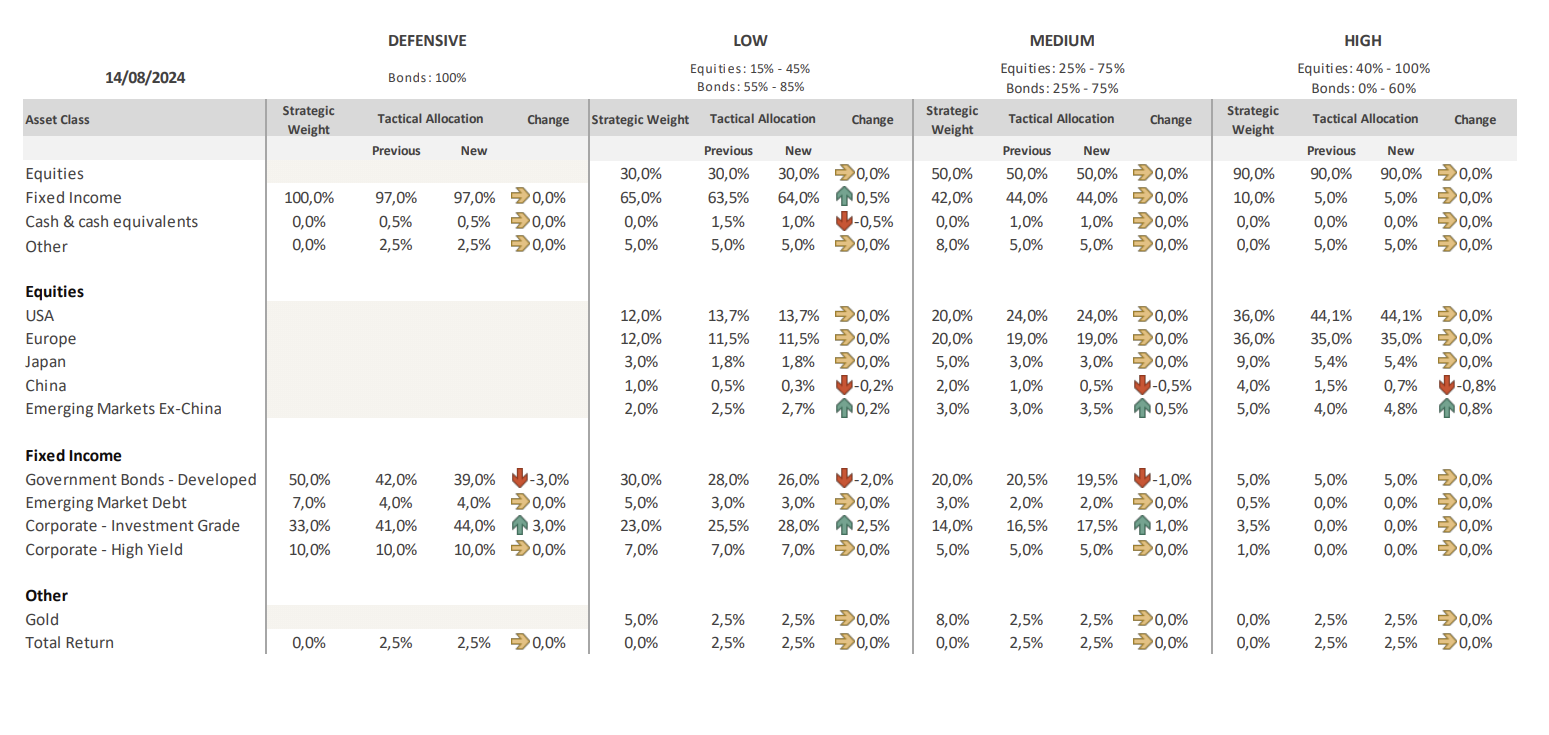

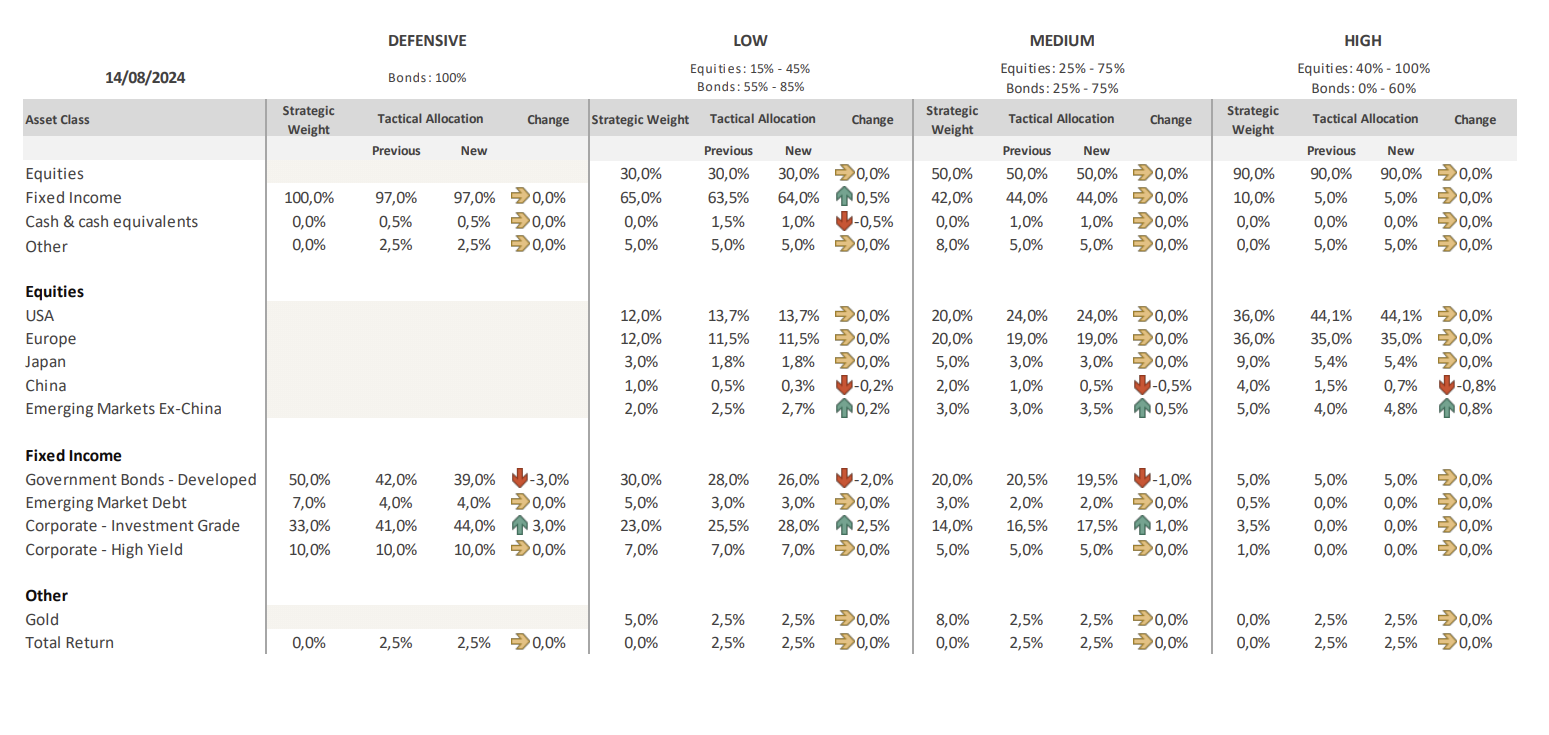

We entered August’s market storm with an underweight position in Japanese equities, having reduced exposure in mid-July, realising the gains from the rally that played out in the first half of the year. Portfolios were also somewhat insulated given that, in July, we had reduced risk by cutting high-yield bond exposure and reinvesting the proceeds in Treasuries. Overall, our balanced allocation between equities and bonds, which favours quality over risk, meant that we were not overly impacted, although it did not prevent us from giving up some of the returns generated in the previous quarter.

At an ad hoc allocation meeting on August 6th, we decided to use the sell-off as an opportunity to add further equity exposure in the High Risk profile, bringing the overall weight to 90% (achieved by increasing US and European exposure by 3.5% each).

EQUITIES

Across risk profiles, we now have a neutral stance on equities, with a slight preference for the US. There, we see a benign mix of variables that should keep risk assets supported in the near term: the Fed is about to begin cutting rates even though inflation is still a bit above target, unemployment is not too high, and the economy is in a slowdown – not a recession.

With no turning point in sight, we deepened our underweight to China, opting instead for Emerging Markets ex-China exposure. It is worth noting that benchmark emerging market indices (which are instrumental in directing capital) will adjust constituents at the end of August, bringing the weight of China down to match roughly that of Taiwan and India, in order to better reflect current dynamics.

We maintain an underweight stance on Europe but have altered the composition of our exposure to focus on broader Europe, rather than the Eurozone. In doing so, we dilute exposure to France (where we think more political volatility is in the pipeline), increase our allocation to countries like the UK and Switzerland where the macroeconomic backdrop is sturdier, and generally bring a more defensive tilt to the portfolios.

In terms of sectors, we still give preference to IT, Utilities, Real Estate, and US Communication Services. We downgrade Consumer Discretionary to Underweight and European Industrials to Neutral. In turn, we upgraded European Healthcare to Overweight, given strong earnings momentum and tailwinds from the ongoing innovation super-cycle.

FIXED INCOME

We reduced exposure to Government Bonds and regular Investment Grade bonds to buy Corporate Hybrids.

Sovereign bonds had a very nice run in July, helped by a more dovish tone from major central banks. The performance accelerated towards the end of the of month as investors became afraid of the R-word again. We feel that these fears were slightly overdone and think that the market’s rate cut expectations might be a bit optimistic (i.e., we see less cuts than markets are pricing). This could put some upward pressure on rates in the short run and we felt it prudent to have lighter positioning in anticipation of this.

Investment grade (IG) also performed well, helped by the lower base rates. While we prune our exposure to regular IG corporate bonds, we remain overweight overall and note that spreads for European IG were only impacted at the margin by the market turmoil.

We decided to plump up exposure to corporate hybrid bonds given the attractive yields that are still on offer. Spreads for these instruments widened and we perceived this as a window of opportunity to increase our existing positions. We opted for corporate hybrids over pure high yield bonds as the former are mostly issued by IG-rated firms with stronger balance sheets. We must acknowledge that the economy is slowing, and we feel more comfortable seeking out yield in subordinated bonds issued by quality issuers.

CONCLUSION

With the ECB already in easing mode, and Powell’s declaration that “the time has come” for the Fed to follow on the same path, the key question for markets is whether a boost from rate cuts can eclipse growth fears. That all depends on how the numbers come in, but current leading indicators do not flag an imminent crisis or recession. If our base case for a slow down in the US and weak growth in the Eurozone materialises, then risk assets might be able to resist gravity for a little longer.

BIL Asset Allocation Matrix

[1] The carry trade is a financial strategy where investors borrow Yen, which typically has a low-interest rate, and then use it to buy assets in US dollars or other currencies offering higher yields

[2] A more detailed account of the events can be found here on our Investment Insights blog

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...