Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an estimated 70% of US GDP, the willingness and ability of US households to spend, matters.

In the period following the pandemic, US consumption appeared infallible. Neither high inflation, nor one of the fastest rate hiking campaigns on record deterred spending. Americans with their shopping carts trampled over the consensus view among economists of late-2022, that monetary tightening would lead to a recession within twelve months. They also compelled most reputable research bodies to revise up their growth forecasts for the US, and to an extent, the global economy.

Fast-forward to today, however, we can see that the factors supporting US consumption are fading…

Combined, generous government stimulus and forced savings amassed during lockdowns, were a proverbial protein shake that helped our metaphorical Atlas to hold up the US economy for so long. A host of fiscal programs, including stimulus checks, expanded unemployment benefits, and child tax credits, injected households with liquidity and relieved expenses, resulting in a remarkable increase in disposable income. But it appears that households have reached the bottom of the glass. According to recent research by the San Francisco Fed, USD 2.1 Trillion in excess savings have now been fully depleted. Meanwhile, the savings rate has fallen to just 3.2%, well below the long-term average of over 8%, implying that US households now have a very thin cushion for when the cycle turns.

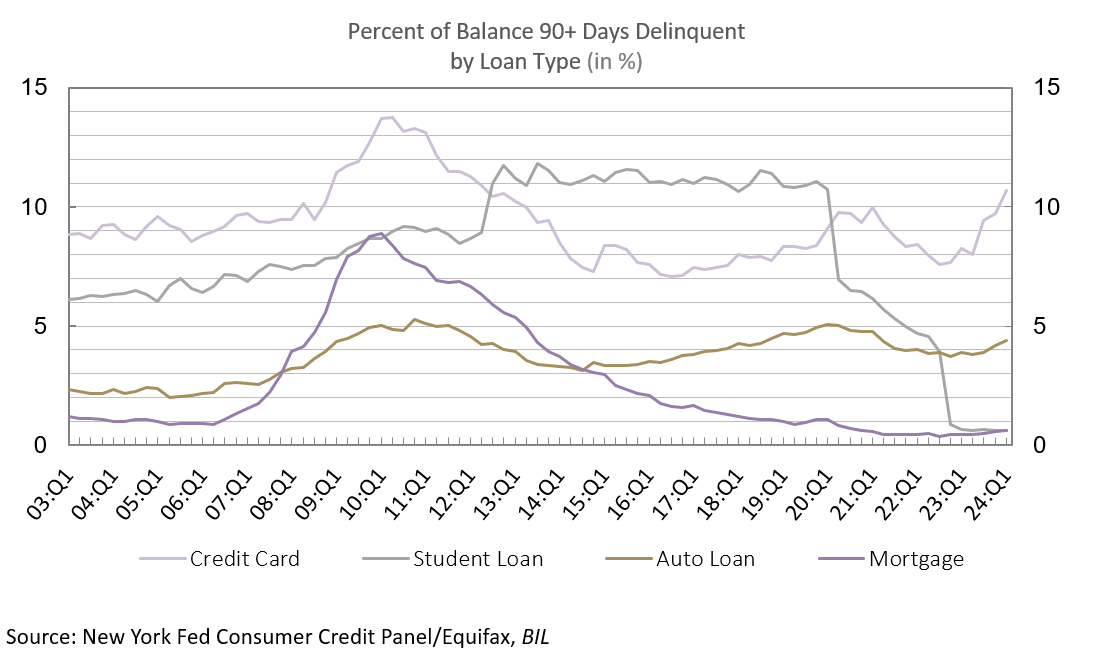

Debt was another supplement allowing Americans to continue indulging post-lockdown. Prior to the pandemic, US credit card debt sat at USD 927 Billion. The most recent data from the Federal Reserve reveals that it now amounts to a staggering USD 1.12 trillion. That’s not to mention the phantom debt in Buy Now Pay Later schemes which official statistics fail to capture. With the average APR on credit card debt currently around 27%, the strain on household balance sheets is increasingly apparent. In Q1 2024, nearly 9% of credit card balances transitioned into delinquency, leaving the total amount in the red above pre-pandemic levels.

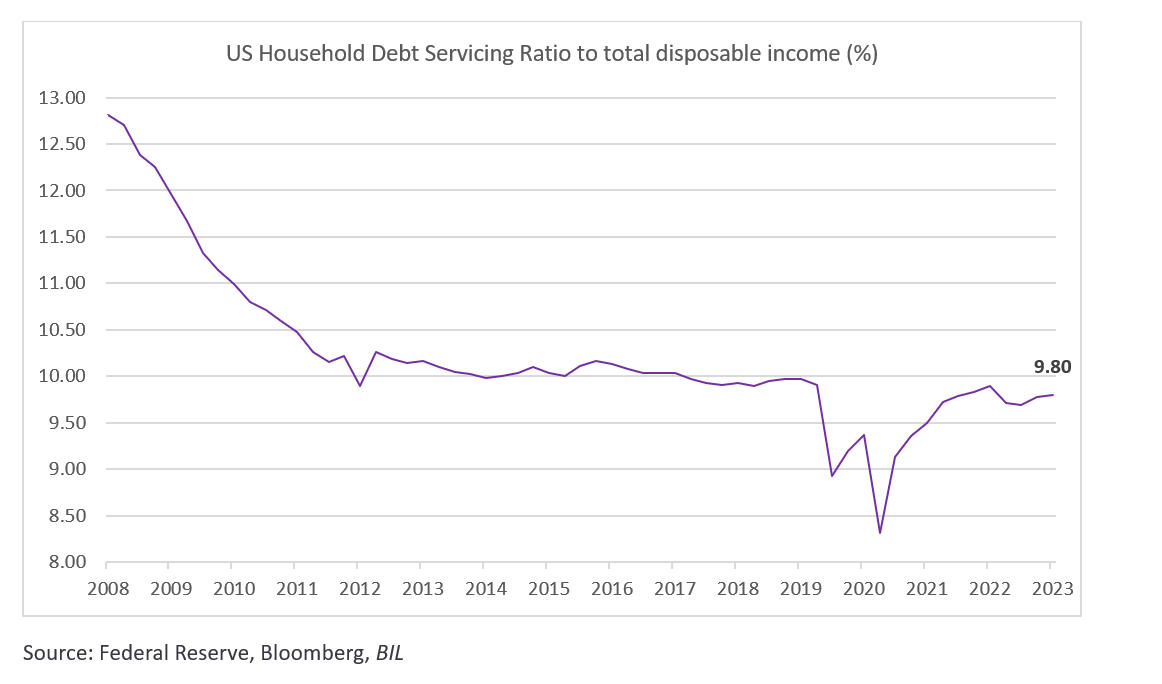

The silver lining is that many US households took the opportunity to lock in low mortgage rates before the lift-off in interest rates (US mortgages tend to be fixed for 30 years). Because of this, the overall household debt servicing ratio [1] still looks very manageable at below 10%.

A third, and probably the most crucial factor supporting US spending, is the labour market. As companies scrambled to hire workers after the pandemic and the ‘Great Resignation’, the US unemployment rate dropped to levels unseen since 1969. Workers enjoyed newfound bargaining power and paychecks ballooned. Now, we see that the once red-hot labour market is cooling – perhaps to a greater extent than official statistics show. The number of job openings is now at the lowest level since February 2021, while after-tax personal income rose just 1.5% in Q1 of this year, the slowest annual advance since 2022. Tellingly, the number of people claiming unemployment benefits has been on a sharp upwards trajectory since late-April. Growth in nonfarm payrolls pushes back against the hypothesis that the labour market is weakening meaningfully, however, we believe that this datapoint will undergo significant downwards revisions in the future due to the way business closures are estimated in the BLS model.

As these supporting factors wane, and with a potentially toxic Presidential election in the pipeline, US consumer sentiment is really starting to turn. The latest Conference Board survey showed that consumer expectations (a good guide to future real consumption growth), have dropped by a sizeable 8.9 points since December, to 73 today. Note that in the past, a reading below 80 has been a recession indicator.

Hard spending data is also decelerating. In Q1, US GDP growth cooled to 1.4%, with a major detractor being a slowdown in spending. Personal consumption grew at an annualised pace of 1.5%, a sharp drop from the 3.3% growth recorded in Q4 2023. Comments on earnings calls from companies acknowledge the slowdown, and the most recent retail sales data has disappointed on the downside. Notably, sales at food services and drinking places has started to drop, hinting that even services consumption – which has been a real lynchpin – is also starting to taper off.

But consumers aren’t only cutting back on treats. In the consumer staples sphere, tighter purse strings are increasingly evident. The number of items scanned at supermarkets dropped by billions in the twelve months to June, and where consumers are still buying, grocery chains note they are “trading down”, i.e., opting for less expensive alternatives such as store-brand products. While households at the lower end of the income spectrum are switching due to necessity, there is also an element of pushback among all consumers with regard to higher prices. Inflation might have retreated (the latest headline CPI was 3.3% YoY), but the compounding of price increases for a year and a half has left everything expensive, and consumers are becoming fatigued.

In all, after spending with relative abandon, all the signs now point to a consumer sector that is increasingly cautious, discerning, or downright unable to consume as much.

Conclusion

The US consumer, the metaphorical Atlas holding up the US economy, undoubtedly looks a lot less athletic today. As the strength of the collective household balance sheet starts to wane, we expect Americans to begin reining in spending going forward. We do not, however, expect an imminent collapse in consumption.

Why? Firstly, a collective move to lock-in low mortgage rates is shielding households from the full brunt of higher rates. Secondly, the labour market may be cooling, but it is doing so from exceedingly strong levels. History suggests that as long as income comes in, Americans are likely to spend it.

Therefore, much now hinges on how much the labour market weakens from here. The recent pullback in spending should help cool the economy, meaning the Federal Reserve will be able to cut interest rates this year before the labour market weakens substantially. If the Fed is forced to wait too long, cutting only once the labour market is mired in a downward spiral, then it would really spell trouble for consumption and probably take the ‘no landing scenario’ off of the table.

[1] The ratio of total required household debt payments to total disposable income

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 19, 2026

Weekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...

January 9, 2026

Weekly InsightsWeekly Investment Insights

Safe haven assets, including gold, rose at the start of the week in response to the US intervention in Venezuela which sparked questions about the...

January 9, 2026

News2026 Outlook

As we step into 2026, the theme of transition will only intensify. In many ways, 2025 marked the starting gun of a new race –...

December 19, 2025

Weekly InsightsWeekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...