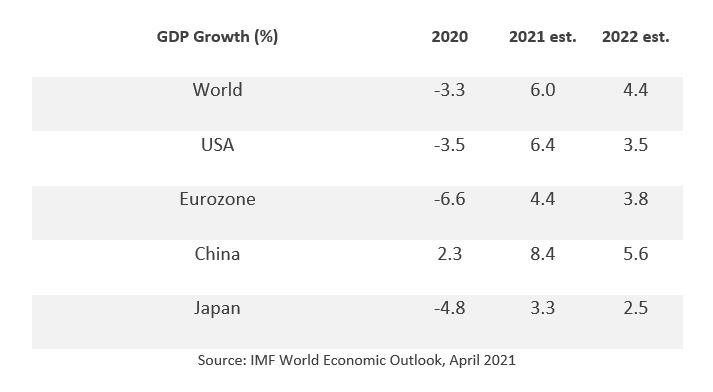

As the global economy heals from the coronavirus pandemic, one economy stands out as a trailblazer when it comes to virus containment, reopening and recovery: China. Amid a global recession, the country eked out positive growth of 2.3% last year and the IMF projects that it will grow 8.4% this year and 5.6% the next. Already, China has recorded a breakneck pace of growth (18.3% annualised) in the first quarter of 2021, with imports and exports rising 28% and 49% (year-on-year), respectively. This recent slate of data further highlights China’s position as an unambiguous engine of growth and as a key player in the broader global recovery.

However, recent developments are just a paragraph in China’s growth story which has been developing for decades. There is a Chinese proverb that states “to know a fish’s habits, go to the water, to know a bird’s song, go to the mountains" ( 近水知鱼性, 近山识鸟音。 ), meaning that to know someone, you should go to his or her home. So, in order to have better insights into China’s development over the years as it grew to become the world’s second largest economy, we spoke to our expert on the ground, Hanzhi Ding, CEO of BIL Wealth Management Limited, Hong Kong.

From emerging economy to global powerhouse

As of today, using traditional growth metrics, China is the world’s second largest economy after the United States. However, Hanzhi notes, if measured using purchasing power parity, according to the World Bank’s international comparison program, the Chinese economy became the world’s largest all the way back in 2017.

China’s ascent has happened in a very short space of time: Since 2010, its economy has doubled and now accounts for just below 20% of world economic output, according to data compiled by Statista.

A major catalyst in China’s growth spurt was its accession to the World Trade Organisation (WTO) in 2001. Hanzhi notes, this was a milestone in the opening-up of China. If the Canton Fair was a window that China opened to the rest of the world, joining the WTO was akin to throwing open the door.

China’s WTO membership ignited a decade-long boom as the country pursued urbanisation and became the world’s leading goods exporter. The next rung on China’s growth ladder came in the aftermath of the global financial crisis when the Chinese government spent billions of dollars, including a stimulus package equivalent to 13% of the country’s GDP at the time, to boost the domestic economy. Most of the money was funnelled into government-led projects, particularly of the infrastructure variety, such as high speed rail lines, metro systems, and airports that still yield benefits today. This stimulus was effective in maintaining economic growth, while other economies contracted.

Over the past decade, China’s growth has been moderating, though it continued to close ground with the US (2016 is an exception due to a depreciation in the yuan). Now, due to its bounce-back from the pandemic, China has increased its share of global output substantially and analysts are surmising that its economy could become the biggest in the world by 2028 – that’s two years earlier than expected before the pandemic. Growth is supported by Beijing’s ambitious projects such as Made in China 2025 and its new dual circulation policy. The latter will see China cultivating its domestic cycle of production, distribution and consumption. This will be pursued via upgrades to the economy, innovation and cutting edge advances in areas such as healthcare, new generation IT, biotechnology, AI and robotics. While China has some of the most complete manufacturing supply chains in the world, it will continue to operate “external circulation”, to globalise China’s homegrown companies and attract more foreign investment into segments like high-end manufacturing.

Beijing

As China grows in size and significance, as does its presence in global capital markets. Twenty years ago, there were barely any Chinese companies in the Fortune Global 500. Today, its more Chinese than it is American. China’s equity market capitalisation is now close to 16% of the world’s total, and its fixed income market has grown from $200 billion to $16 trillion in the space of two decades. China’s representation in global markets is poised to keep expanding as more and more onshore companies are included in global benchmark indices (for example, the MSCI All Cap World Index). On top of that, the gradual opening of China’s A-share market (i.e. its onshore markets) to international investors will transform the landscape of global capital markets.

CIO View: Capturing Opportunities

At BIL, we are long-term investors and economic facts underpin our investment decisions. Throughout our analyses, China is the region that continues to flash green, due to its strong macro momentum today. On top of that, myriad opportunities could flow from the continuation of the country’s growth story over the long term as China graduates from being an export-driven economy to focus on value-add sectors, innovation and domestic consumption.

What is surprising is that despite China’s size and potential, the region tends to be under-represented in investor portfolios. In the past, this may have been due to perceived complexity, risk aversion and constraints when it comes to access. This is an anomaly that could resolve itself moving forward and to use another Chinese proverb that may prove wise… 先到先得。— The first to arrive is the first to succeed.

Investors are now contemplating their exposure to China’s compelling growth story. While Chinese assets have typically offered diversification (due to lower correlations), they now potentially offer more alpha opportunities than in regions such as Europe, which are stuck in the slow lane with the health crisis still weighing on the outlook. As always, higher returns usually mean more volatility, but a curated exposure could mean willing investors are rewarded for taking on additional risk.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 19, 2025

Weekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...