Choose Language

December 15, 2022

NewsDecember FOMC: shifting down a gear

- Fed fund rate increased by 50bp to 4.25% - 4.50%

- Decision taken unanimously

- New dot plot released

Yesterday, at its final FOMC of the year, the US Federal Reserve raised its benchmark policy rate by half a percentage point, to its highest level since 2007, and signalled its intention to keep tightening next year.

The committee voted unanimously to increase the federal funds rate to a target range of 4.25-4.5%, ending a string of bumper 75bp hikes.

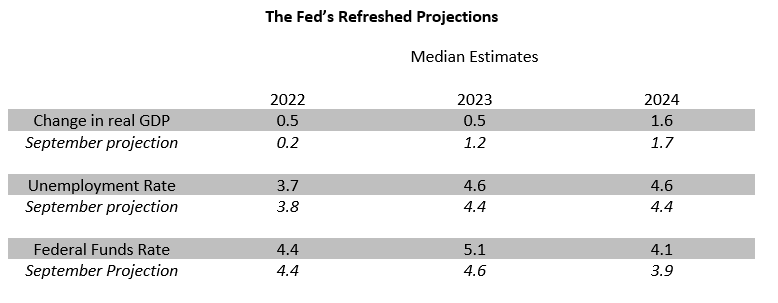

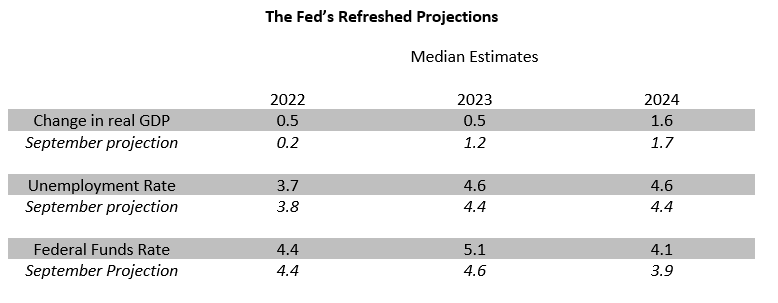

Alongside the rate decision, the Fed published a revised “dot plot” of officials’ individual interest rate projections. The median estimate for the fed funds rate by the end of 2023 rose to 5.1%, up from 4.6% in September and quite a bit higher than the 4.8% terminal rate the market had priced ahead of the meeting. Powell added that he couldn’t say, “confidently that we won’t move up our estimate . . . again.” This will depend on incoming data.

No recession was mentioned but the refreshed economic projections envisage growth of just 0.5% in 2023 before a 1.6% expansion in 2024 as the unemployment rate tops out at 4.6%. The labour market continues to show resilience and Powell highlighted the “extremely tight” dynamics and the pressure higher wages would put on companies’ labour costs and ultimately inflation. Wages are currently growing at a pace of 5.1% YoY – about 2 percentage points quicker than Powell believes is consistent with bringing inflation back down towards 2%.

Bond markets initially declined on what was perceived as “tough love” from the Fed but then appeared to grow sceptical that the Fed will stick to its guns. In futures markets, bets are on that the Fed will cut rates next year as the economy slows, essentially disputing the dot-plot which did not show any cuts in 2023.

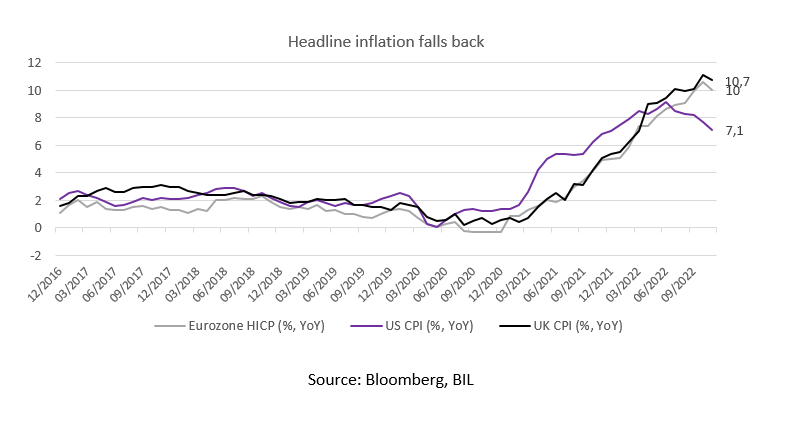

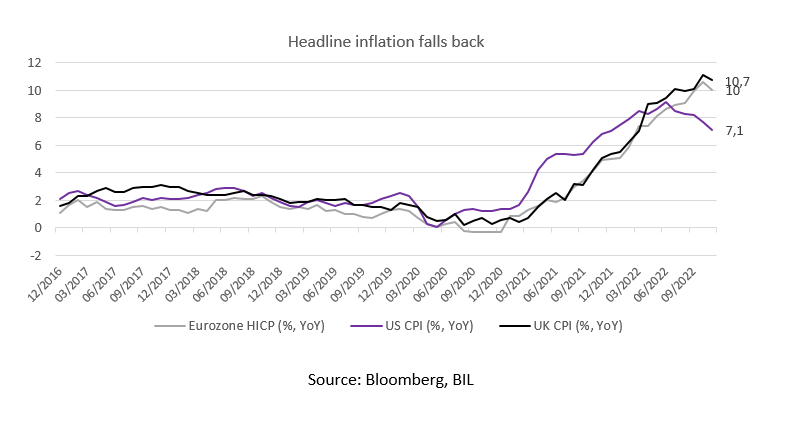

The Fed’s de-acceleration in the pace of hikes was followed across the Atlantic with both the BoE and ECB delivering 50bp hikes. Headline inflation appears to have peaked in all three regions, but concerns remain about how long it will take for it to come back towards their 2% targets, having seeped into stickier categories like rents and wages.

Conclusion:

- More Fed hikes to be expected at following meetings

- Economic data will determine the pace of further hikes

- Economic slowdown expected in the US that could lead to higher unemployment (no word on recession)

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...

November 22, 2024

BILBoardBILBoard December 2024 – Red Sweep

At BIL, we are long-term investors guided by stable, strategic asset allocation guidelines. However, our investment strategy itself is a living, breathing thing,...

November 18, 2024

Weekly InsightsWeekly Investment Insights

Less than two weeks after the US Presidential election, Trump has made significant progress in nominations for top government posts, leading to some market...