Choose Language

November 16, 2020

NewsEurope: Growth expectations fall in the Autumn Economic Forecast, but help is on the way

The eurozone recorded its fastest rate

of expansion since records began in 1995 in the third quarter, but the European

Commission took the gilt off the gingerbread by revising down its growth

forecasts shortly after, pointing to the pandemic’s resurgence. Nonetheless,

more fiscal and monetary support is forthcoming.

Quarter-on-quarter, the eurozone economy

expanded 12.7% in Q3, versus 9.4% expected, but a new series of lockdowns,

curfews and restrictive measures threatens to put a spanner in the works. As

Maarten Verwey, European Director General Economic and Financial Affairs

comments, ‘The combination of renewed fear about the spread of the disease and

lockdown measures is weighing on economic activity in the short run and putting

the nascent recovery on hold.’ While, the EU commissioner, Paolo Gentiloni

said: ‘Growth will stall in the fourth quarter and pick up in the first part of

2021.’

A recovery on ice is much better than a

recovery falling into reverse. For now, a double-dip recession is not our base

case, however, it cannot be ruled out if new restrictions fail to contain the

virus swiftly.

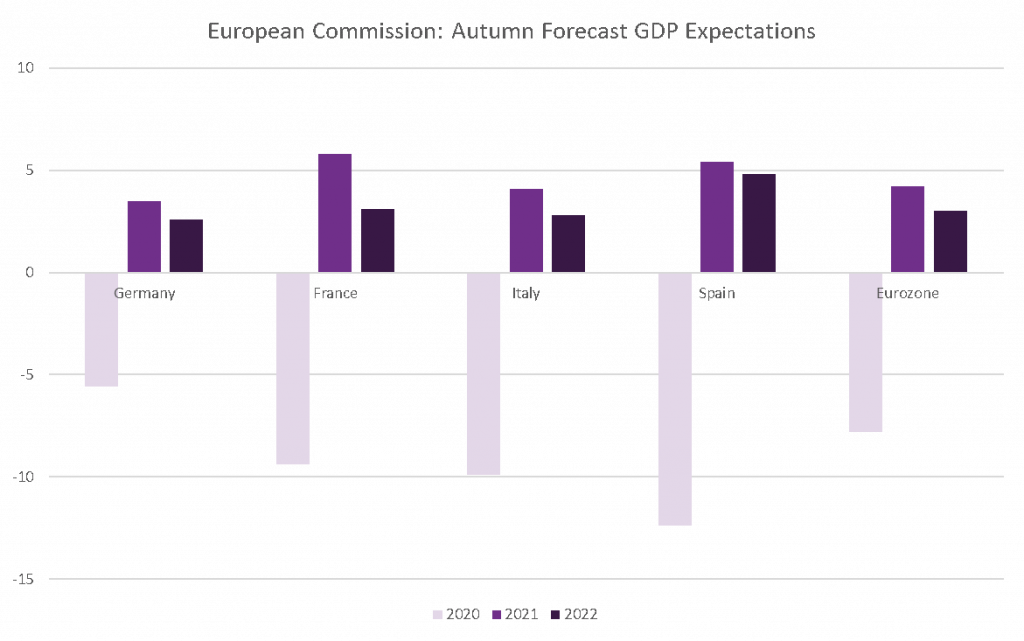

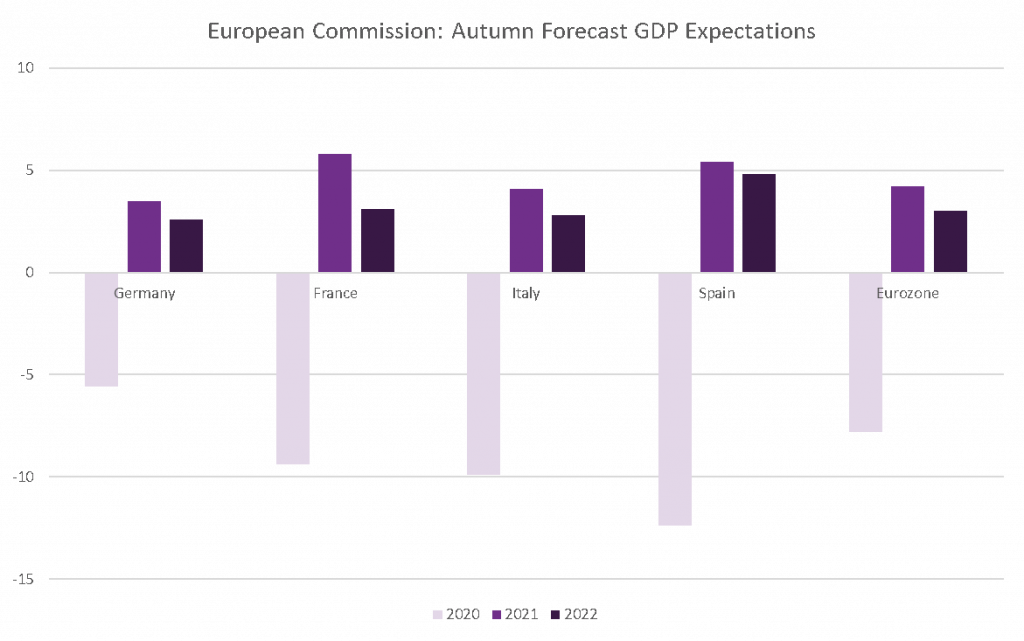

After factoring new government-imposed restrictions into its forecasts, the European Commission’s Autumn Economic Forecasts predicted the EU economy to shrink 7.4% this year, unchanged from its previous forecast, but expectations for 2021 were cut by 2% from +6.1% to +4.1%. The broad figures, however, mask the very uneven recovery that is playing out, as seen below.

The economic trajectory of individual

countries has largely depended upon their ability to keep a lid on the pandemic

while, at the same time, countries with manufacturing at the heart of their

economy have managed to make a gradual comeback with supply chains mended and

export demand picking up. Those countries with service based economies,

especially those reliant on tourism, are still in the doldrums: The IHS Markit

Manufacturing PMI rose to 54.8 in October, while the Service equivalent came in

at 46.9. 50 is the level that separates contraction from expansion.

New mentions of the “R” word, the

unevenness of the recovery and the fact that inflation has been in negative

territory for three months in a row (most recently -0.3% in October), should

spur policymakers into further action.

On the fiscal front, now that the EU

Parliament has reached an agreement on the “rule of law conditionality”[1],

it is hoped that the EUR 750bn recovery package can start being disbursed

before the end of the year.

On

the monetary policy side, the ECB has primed us for even more stimulus at its

December meeting. The shape and size of the ECB’s Christmas present is subject

to speculation but consensus expects that the EUR 1.35 trillion pandemic

emergency purchase program will be expanded by six months until the end of

2021. Since the bond-buying plan was announced in March, the ECB has only used

half of the available money. Other predictions include an expansion of the

bank’s other asset purchase program which is running parallel to the PEPP,

buying EUR 20 billion worth of bonds per month, plus a “temporary envelope” of EUR 120 billion.

It’s currently scheduled to run until the end of this year. Cognizant of the

weight of negative interest rates on bank balance sheets, it may be expected

that the ECB expands its long-term lending scheme to banks rather than taking

the scissors to rates. The last thing the eurozone needs is for credit flows to

thin.

Then there is the chance that Ms. Lagarde chooses to add her own signature to the policy mix, bringing something entirely new to the table – after all, she did use the word “recalibration” some 20 times at her last press conference. The parcel will be unwrapped on December 10th and the contents had better not be a tangerine or a lump of coal, or else markets could get stroppy.

[1] A clause which states that EU countries

must uphold the European rule of law (i.e. judicial independence) or risk

losing access to the funds. The specification faced strong opposition from

countries such as Hungary and Poland.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...

February 10, 2025

Weekly InsightsWeekly Investment Insights

US equities ended lower last week, amid tariff uncertainty stemming from the Trump administration. While proposed tariffs on Canada and Mexico were postponed for...

February 3, 2025

Weekly InsightsWeekly Investment Insights

By Friday, it seemed as though a volatile week for stocks had ended on a positive note. The damage caused after Chinese AI app DeepSeek...