November 5, 2024

NewsEurope heads into winter two years after the energy crisis

The 2022 energy crisis was a wakeup call for Europe, revealing Europe's energy vulnerability. A lot has been done been since, from reducing dependence on Russian gas to cutting overall gas consumption by 18%. Households have made great effort to change their habits, but much is still to be done to ensure long-term stability in energy supply.

Two years ago, European households headed into the winter not knowing if they would be able to keep their homes warm throughout the cold months. In 2021, Russian natural gas accounted for 44% of the EU’s natural gas imports; its invasion of Ukraine forced the EU to rapidly find new ways to keep gas flowing by diversifying supply, and to quickly reduce demand.

Energy inflation soared to an all-time high in March 2022, with energy prices up by around 44% on the previous year. This put immense pressure on households and businesses across Europe as they struggled to keep the lights on. This situation also highlighted the inherent risks of Europe's dependence on other countries, as recently lamented by former Italian prime minister and ECB chief Mario Draghi in his report "The Future of European Competitiveness".

Liquified natural gas (LNG) emerged as a new player on the European gas markets

Until the 2022 energy crisis, European countries had relied mainly on piped gas for their gas consumption, but with the need to diversify gas supplies, seaborne Liquified Natural Gas (LNG) became key to ensuring Europe's energy security, replacing a large portion of pipeline imports from Russia. In 2022, the US became Europe's top LNG supplier, while Norway replaced Russia as the top overall gas supplier.

At the peak of the energy crisis, over 41 million Europeans were not able to warm their homes adequately, according to the European Parliament. The EU stepped in to help people and businesses unable to pay their energy bills, but it also had to tackle one of the drivers of rising prices: demand. EU countries and citizens were urged to reduce gas consumption, which, according to the European Council, fell by 18% in the EU between August 2022 and May 2024, compared to the previous five years.

Changes in behavior helped reduce demand

By 2024, households had still not returned to their pre-crisis consumption levels, and while their willingness to change their habits—whether voluntarily or due to financial pressure—was crucial in reducing demand, other factors also played a role. The relatively mild winter of 2022 led to a decrease in energy used for heating buildings compared to the previous year. Additionally, the installation of 3 million heat pumps in 2022 contributed to lower gas demand. Authorities hope that changes in consumption habits and a focus on energy efficiency in buildings will sustain the downward trend in gas consumption in the coming years.

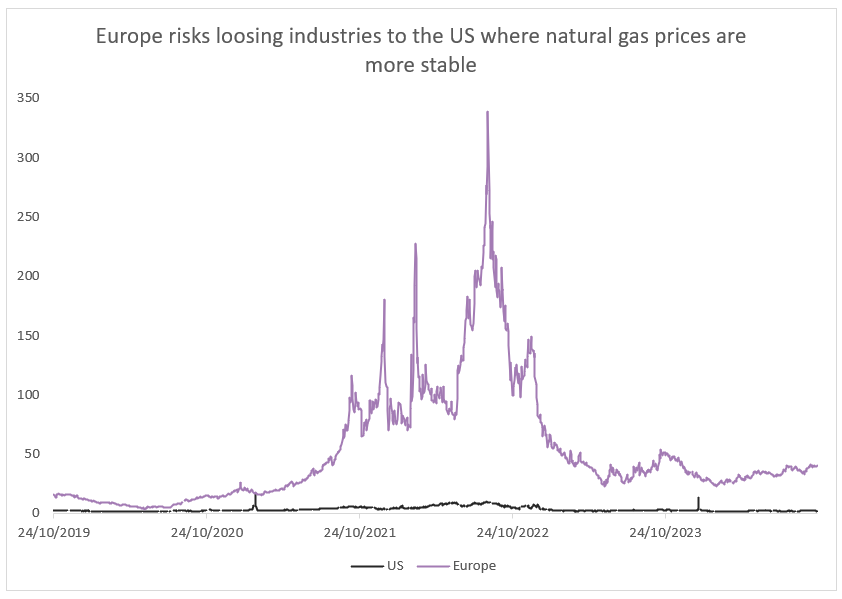

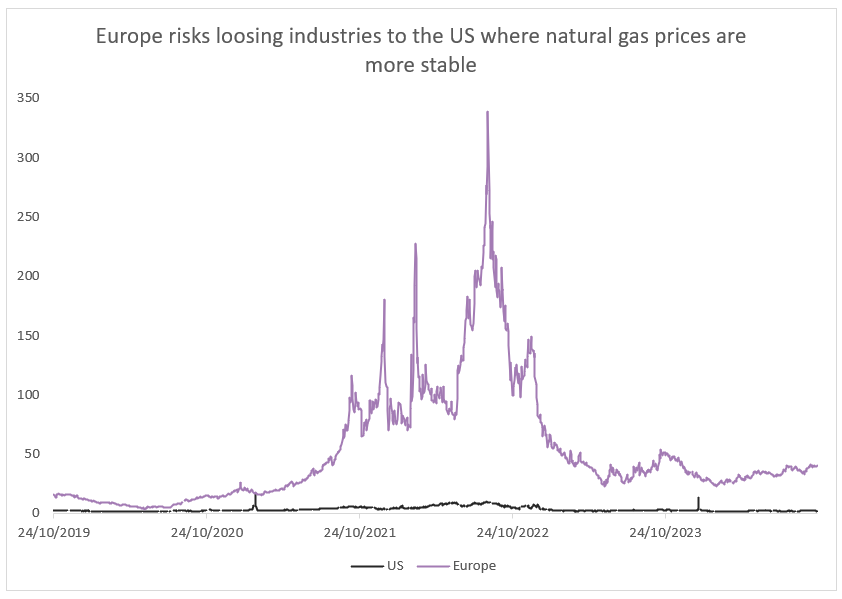

When gas prices soared, energy-intensive European industries had to scale back their operations. Although prices have returned to more acceptable levels, industrial demand has not yet regained its pre-crisis levels. Illustrative of this, output in industries, such as chemicals and fabricated metal products, has declined.

Energy consumption is still lower than before the crisis, not just because of changing habits, but also due to lower economic activity. A recovery in industrial activity could therefore alter the recent trend in energy demand.

Changes in the European energy market

This year, the EU’s 90% gas storage target for natural gas was reached ten weeks ahead of the November deadline, a threshold that was put in place to ensure an adequate supply of energy and to protect citizens from high energy prices.

Overall Russian gas imports by the EU fell to 16% in August 2024. The commission of twelve new LNG terminals between 2022 and 2024 certainly contributed to this drop. Although overall gas demand has cooled substantially, and LNG demand in Europe falling 20% in the first half of the year, the LNG infrastructure investment is key in protecting Europe from future supply shocks. This will also be crucial to prevent energy-intensive firms relocating production elsewhere because of unstable supply. The BDI business association has said that around 20% of industrial value creation in Germany is under threat, listing high energy prices as one of the key reasons.

Source: Bloomberg, BIL

The EU has also shifted into a new gear when it comes to the use of renewable energy sources, with more electricity generated from wind and solar power than from fossil fuels than ever before. According to the European Commission, EU electricity was generated from 46% renewables, 29% fossil fuels, and 25% nuclear at the start of this year.

The move away from gas increased the demand for electricity to heat European homes. Heat pumps were highlighted as a key instrument to reduce the EU’s dependence on Russian gas which gave the heat pump market a significant boost in 2022. However, this trend has not retained its strength with gas prices falling in 2023 and cost of living rising, making the switch to electricity driven heat pumps less financially attractive.

Although electricity prices have been on a downward trend in 2024, southern Europe, in particular, are still experiencing volatility. A Greek government official stated that it feels “like there is a mini energy crisis that no one is talking about”, in reference to Russian attacks on Ukrainian infrastructure. As supply dynamics shift in Europe, the EU's need for capacity to share supply across borders has come into focus.

Going forward

The 2022 energy crisis was a wakeup call for Europe. A lot of progress has been made to replace Russian gas flows, stabilise volatile energy prices and increase the use of renewable energy sources. The transition to renewables and sharing across internal EU borders will be vital for the security of Europe's energy supply in the coming years. Continued efforts to improve the energy efficiency of European buildings will also be crucial to keep gas demand low in the long term. Taking a longer-term view, the advent of AI and smart homes that regulate their own heating could form part of the solution one day. However, AI is also expected to increase energy use significantly. The International Energy Agency expects that global electricity consumption from data centers, AI and cryptocurrency could double in 2026 compared to 2022, increasing electricity demand by as much as another Germany.

Although vital progress has been made, there is still a long way to go and while energy prices have dropped considerably, EU companies still face electricity and natural gas prices that are well above those in the US. In his report, Mario Draghi highlights the potential for Europe “to take the lead in new clean technologies and circularity solutions, and to shift power generation towards secure, low-cost clean energy sources in which the EU has generous natural endowments.” This might represent short-term pain for long-term gain, but it is yet to be seen whether Europe will fully embrace the proposals.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 23, 2025

NewsThe Gold Rush

In recent months, gold has experienced remarkable momentum, solidifying its position as a preferred safe haven asset. Contrary to what the collective imagination suggests,...

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...