Choose Language

February 22, 2022

NewsGeopolitical tensions: is it time to take cover in risk assets?

Over the past weeks, the attention of financial markets and the international community at large has been consumed by geopolitics. While the epicentre of tensions lies along the Russia-Ukraine border, the implications of any potential conflict reverberate around the world, with North America and the EU inextricably linked to ongoing events.

The news flow has been hot and cold making it difficult to deduce what is truly at play beneath the headlines. The threat of an invasion of Ukraine has dominated news wires since Russia amassed some 190,000 troops along the border with its neighbour. However, last week, President Putin said that Russia was ready to hold “dialogue” and last Tuesday, Russia said that some personnel stationed near the Ukraine border were beginning to return to their bases. However, by Thursday, US President Biden was warning that Russia was on the brink of invading Ukraine within “several days” and on Friday it was reported that Russia was about to begin conducting nuclear tests. Over the weekend, Belarus announced that some 30,000 Russian troops participating in joint drills would stay in the country indefinitely. Already scuffles have broken out in the Donbas region and a new ceasefire hasn’t been fully re-established. On Monday, the Russian army claimed it had killed five Ukrainian troops who crossed into Russia and then in the evening, Putin signed decrees pronouncing the sovereignty of the rebel-held Donetsk and Luhansk territories in the east. Russia then directed its military across the border and into these zones; a move which Russia said was “peacekeeping”, but one that the West viewed as escalation and a precursor for a full invasion. This prompted the US to impose some limited sanctions with more expected Tuesday. The UK is also due to unveil its own punitive measures.

The US has warned that Russia is engaging in false flag activities which it could use as a pretext for an invasion of Ukraine, while British Prime Minister Boris Johnson said that Russia was planning "the biggest war in Europe since 1945".

The week ahead is set to be paramount with Russian Foreign Minister Lavrov and US Secretary of State Blinken due to meet. Over the weekend, French President Macron held phone calls with President Putin and brokered a summit between Biden and Putin which may take place later this week once Lavrov and Blinken have laid the groundwork. White House officials confirmed the summit and said that Biden accepted the meeting “in principle” but insisted that it would occur only under the condition that Russia does not invade Ukraine. It is yet to be seen how the latest developments affect these plans.

Public posturing

In the past, such discussions would have taken place behind closed doors, out of the public eye, while military intelligence was distributed on a “need to know” basis. In a sign of the times, much of the current situation has been hashed out in the public domain, in fitting with a new era of abundant information and a race to control the narrative. This public war of words makes it very difficult to infer what is actually going on and it also brings about a whole new level of brinkmanship. One broadcasted slip of the tongue could have extreme consequences. We can only hope that a peaceful, diplomatic solution is found.

Portfolio Positioning

As of late, markets have been moving to a beat dictated by the drums of war. When more benign news is released and the drums grow fainter, risk assets make a comeback. When more ominous news emerges, we have seen textbook risk-off positioning with equities selling off and safe havens strengthening. With new updates daily from various stakeholders, the situation is very fluid and market volatility sits around year-to-date highs.

Should the worst case scenario play out and the situation deteriorate, there are some asset classes that would be directly in the firing line.

With Russia being the world’s second-largest crude oil producer, the first is naturally oil. UK Prime Minister Boris Johnson has already warned about the precariousness of "the drip feed of Russian hydrocarbons that is keeping so many European economies going". Until now, optimism around an Iranian nuclear deal (which could ultimately see the US list sanctions on the country’s crude exports) has capped upside price momentum. However, President Biden has been quite clear that the US will defend Ukraine. This could mean economic sanctions on Russia, which in turn would likely have implications for its ability/ willingness to export energy. If this was to come to fruition, we could expect oil to breach $100 per barrel; a price level that would have significant implications for inflation prints and growth in most major regions. Of course, this is for now a hypothetical scenario.

Then there is natural gas, touted as the “bridge fuel” in reducing reliance on fossil fuels. Western Europe leans heavily on Russia for natural gas supplies which are sent through several main pipelines such as the Nord Stream, the Yamal-Europe and the Brotherhood (Russia accounted for around 40% of extra-EU imports of natural gas in 2020). The gas is collected in regional storage hubs and then distributed across the continent. A second Nord Stream pipeline has been built between Russia and Germany - but there are hints that its approval (already a bone of contention with the US) could be denied if conflict intensifies. Over the past months, energy prices have spiked across Europe due to a whole host of factors, helping inflation in the Eurozone rally to 5.1% in January, a level unseen since the currency union was created (the energy component of the inflation basket rose by a record 28.6% year-on-year).

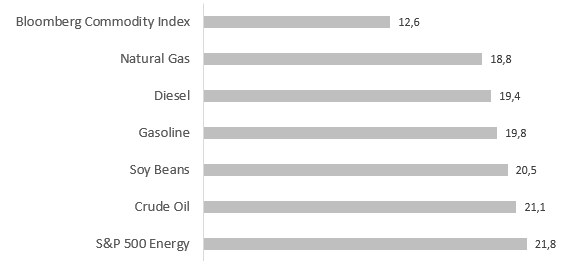

Performance of selected global stock indexes, bond ETFs, currencies and commodities (USD, YTD, %)

Source: WSJ, 21st February 2022, BIL

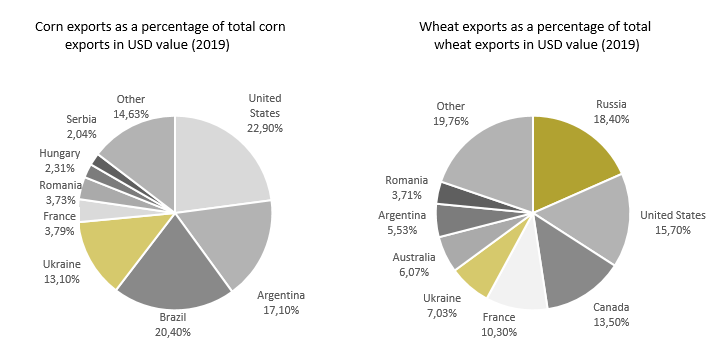

With rising food costs already squeezing household budgets, then comes concerns about wheat prices under any eventual conflict. Russia is the world’s top wheat exporter while Ukraine is often referred to as the breadbasket of Europe; it is also an important exporter of corn. These commodities are shipped from ports in the Black Sea which could face disruptions if military action was to commence or if sanctions were enacted. This in turn risks stoking already-high food inflation (growth in the cost of unprocessed food accelerated to 5.2% in the eurozone in January).

Source: OEC, BIL

Should we see diplomacy attempts turn pear-shaped, we would expect to see typical safe haven assets outperform: namely gold and the US dollar. Equities and other risk assets would likely fall into the red. However, it is worth noting that over a thirty-year timespan, equity sell-offs catalysed by geopolitical events such as terrorist attacks or wars have often gone on to demonstrate relatively quick recoveries, highlighting the fact that the market is not very good at pricing in geopolitical risk. For now, while there is so much headline noise, we prefer to keep our focus on long-term market drivers such as central bank policies and economic growth (which is still there for the time being): Betting on political outcomes is more akin to gambling at this stage.

As such, we have thus far refrained from the urge to hunker down in safe haven assets and have kept our current positioning with an equity overweight centred around sectors such as Energy (a sector that benefits from strong revisions), Materials (which still stands to benefit from higher commodity prices) and Financials (which benefit from higher interest rates and inflation). Our overweight on Healthcare, a more defensive play, adds ballast when volatility picks up. We also maintain our positive view on the US dollar which in any case is receiving a leg-up on prospects of tighter monetary policy from the Fed. We keep this positioning in the hope that world leaders do not forget or become complacent about the horrors of war, something Anthony Doerr the writer describes as “a bazaar where lives are traded like any other commodity: chocolate or bullets or parachute silk”. Let’s hope our leaders can work together to find a diplomatic and peaceful solution in the knowledge that amplifying this conflict would represent a worst case scenario for all parties.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...