Choose Language

July 28, 2022

NewsIn focus today: US GDP Growth

- The Atlanta Fed GDPNow tracker suggests today’s US GDP print might come in negative

- This would mean two consecutive quarters of negative growth – in fitting with common definitions of a “technical” recession

- But is the US really in a recession?

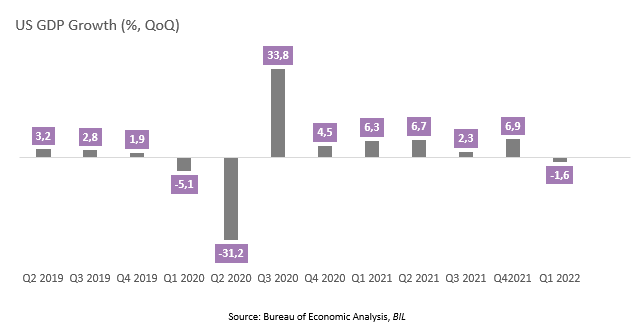

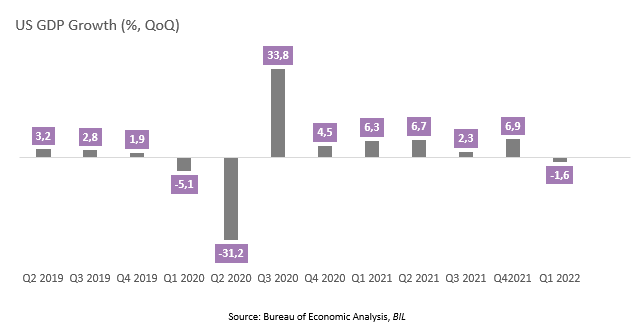

Today, the Bureau of Economic Analysis will release its preliminary estimate for US GDP growth in the second quarter of the year. The Atlanta Fed GDPNow tracker suggests we will see a contraction of 1.2%. After the -1.6% recorded in Q1, by common definitions, this would mean that the US in in a “technical recession”.

But is the US really in a recession? Ultimately, that’s for the National Bureau of Economic Research (NBER) Business Cycle Dating Committee to decide.

The NBER defines a recession as a significant decline in economic activity that is spread across the economy and lasts more than a few months. In its interpretation of this definition, it treats three criteria – depth, diffusion, and duration – as somewhat interchangeable.

In other words, the goal posts might move around a bit.

The first thing to highlight is that the contraction in Q1 was largely due to a jump in imports, which led net foreign trade to subtract a substantial chunk from GDP (3.2 pp) as wholesalers and retailers capitalised on easing supply constraints to rebuild inventories. Real inventories rose by a huge $150bn in Q1, but because this was smaller than the $193bn increase in Q4, 1.1 pp was clipped from the GDP figure. Imports of nominal non-oil goods rose at a staggering (and unsustainable) pace of 42% on an annualised basis, while exports rose by 6%. Meanwhile, consumer spending and fixed investment (which together make up over 80% of nominal GDP)—grew at a 3% real annualised rate, demonstrating solid, above-trend growth. Payroll employment grew at an even stronger 4.7% annualised.

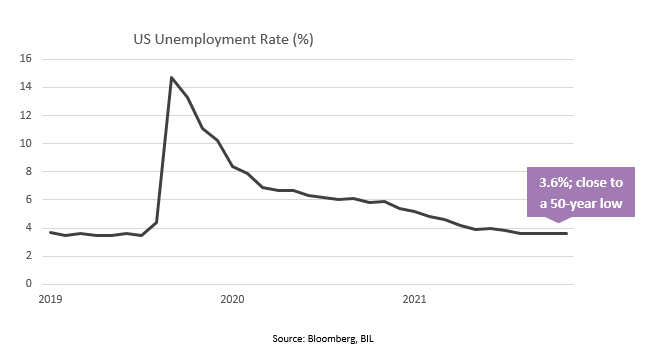

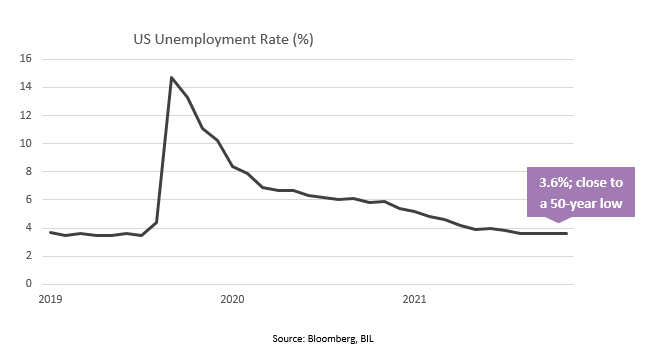

The exceedingly strong labour market, which persisted into Q2, is the one aspect that really pushes back on the recession narrative. Fed Governor Waller has said that it is “inconceivable” to have a recession when unemployment has been at 3.6% for four months running. Treasury Secretary and former Fed Chair Janet Yellen has also noted labour market strength in downplaying recession fears, stating that 1.1 million jobs were created in Q2—an average of around 375k per month— more than three times more jobs created than in any 3-month period leading up to a recession. Rather, she states, “we’re in a period of transition in which growth is slowing and that’s necessary and appropriate and we need to be growing at a steady and sustainable pace.”

A final consideration is that the period of high and accelerating inflation we have had makes positive GDP growth much harder to achieve as the figure is reported in real terms (i.e. adjusted for inflation). Consumer spending data provides a good example of this. Adjusted for inflation, real retail sales have been negative for two consecutive months. In other words, US consumers are spending more money to buy less in volume/quantity.

Ahead of a potentially negative growth print, the White House posted a note on its website pushing back on the recession narrative, stating that data on the labour market, consumer and business spending, industrial production and income does not suggest that we are in a “true” recession (though of course there are likely political motivations behind this given the upcoming Midterm elections.)

From an investment standpoint, whatever the GDP print says, it is a backwards looking datapoint. Combining this with forward-looking equity market pricing is the tricky task and history shows that letting the former guide you in allocating to the latter is not usually a good way to proceed.

However, leading indicators such as PMI surveys suggest that the risk of a real recession is rising and we cannot rule that out. Given the importance of consumption to the US economy, investors are more likely to look to personal income and spending data and the PCE index, which will be released across Thursday and Friday, for more clues on the current health of the US economy.

Sources:

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...