Market Snapshot

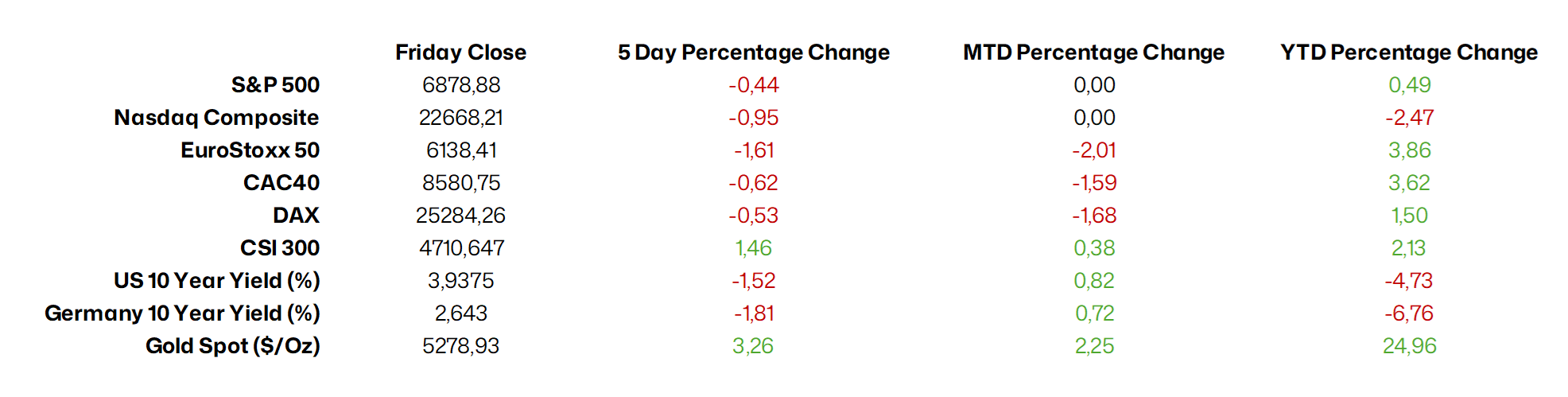

Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and Israel launched coordinated air strikes against Iran, targeting ballistic missile sites, naval assets, Revolutionary Guard facilities and air defense systems. Iran’s Supreme Leader Ayatollah Ali Khamenei was killed along with dozens of senior officials. Tehran retaliated broadly across the Middle East, directing a wave of missiles at Israel and US military bases, and threatening critical infrastructure to the global energy market. Activity in the Strait of Hormuz, through which a fifth of the world’s oil and gas flows, has slowed to a near halt following the strikes, disrupting energy supply.

Brent crude, the international benchmark for oil prices, rose 13% to above $80 per barrel, while European gas prices increased by 24%. Gold briefly traded above $5400/Oz and global stock markets fell as investors sought out safe havens amid heightened uncertainty. The US dollar strengthened against a basket of currencies, including the euro and the British pound, in another sign that investors were seeking safety. In the stock market, European airline and banking stocks decreased, while energy, shipping and defence stocks rose. Futures pricing implies that US markets will open in the red, with investors having fresh reasons to trim their equity positions amid rich valuations.

As of now, the spectrum of possible outcomes is broad, ranging from diplomatic negotiations to a prolonged regional conflict.

Source: Bloomberg, BIL as of March 2

Macro Snapshot

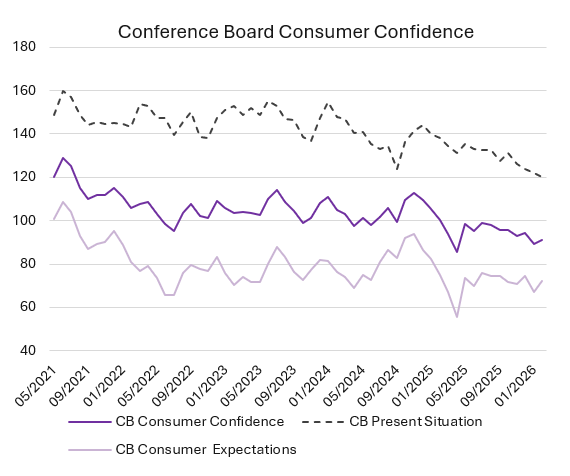

US consumer confidence improves in February

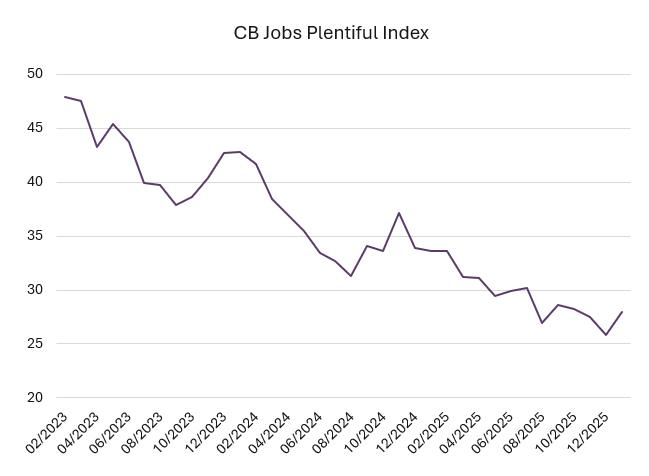

The Conference Board consumer confidence index rose by more than expected to 91.2 in February, from 89 the month prior, but concerns about the labour market remain prominent. The share of consumers viewing jobs as “hard to get” rose to a five-year high.

The improvement in confidence was mostly recorded by respondents identifying as Republican and Independent. Inflation continues to be top of mind for consumers, with President Trump under increased scrutiny for his implementation of sweeping tariffs that have raised prices.

In line with other data points hinting at stabilisation in the job market, perceptions of the labour market improved slightly, but remain depressed overall.

Source: Bloomberg, BIL

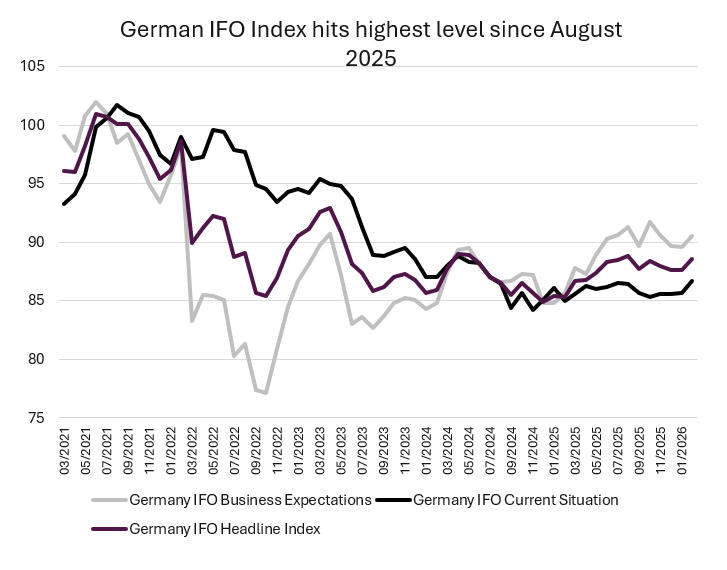

Germany’s Ifo Index signals stabilisation in the business climate

After a month of grey weather, the European continent shifted gears into spring-like temperatures, as a Heat Dome expanded over the heart of Europe in the final days of February. Germany’s business environment also appeared to be warming up, with the Ifo Business Climate Index rising to 88.6, up from 87.6. While still subdued, the uptick marks a cautiously encouraging signal for Europe’s largest economy.

According to Ifo President Clemens Fuest, firmer domestic demand and the government’s fiscal measures are beginning to support economic activity. However, he cautioned that elevated trade uncertainty continues to burden export‑oriented industries, a key pillar of the German economy.

Sentiment improved across several major sectors:

- Manufacturing: Climbed to –11.3 from –12.3, reflecting better expectations in industry.

- Services: Rebounded into positive territory (0.1 vs. –2.6), driven largely by improved outlooks in the logistics sector.

- Construction: Also saw an uplift (–11.5 vs. –14.3), though activity remains weak by historical standards.

Overall, Germany appears to be moving toward modest economic growth in 2026, supported by improving industrial expectations and better consumption prospects. A gradually improving labour market should bolster real household income, providing an additional cushion to domestic demand.

However, the rebound remains fragile, and structural challenges continue to weigh on business confidence.

Despite a fiscal policy boost, which is expected to become more apparent in the second half of the year, the Bundesbank expects only limited impact on Germany’s potential output. It stressed that broader structural reforms will be required to sustainably strengthen long-term growth capacity.

Source: IFO, Bloomberg, BIL

UK consumer confidence falls as labour market weakness weighs on confidence

The GfK Consumer Confidence Index fell from -16 to -19 in February, reversing the previous two months' gains, as concerns about the labour market dampened households’ outlooks. Indeed, the unemployment rate climbed to a post-pandemic high of 5.2% in the three months to December, youth unemployment increased, and wage growth weakened.

The overall decline in consumer confidence was largely driven by deteriorating views of personal finances, which is seen as an indicator of future consumer spending. Consumers' perception of whether it is a good time to make major purchases also weakened.

However, falling inflation and further interest rate cuts by the Bank of England are expected to boost consumer spending over the year as consumers become more confident about their spending power.

Calendar for the week ahead

Monday – Switzerland Retail Sales (January), Manufacturing PMI (February). Eurozone, US & UK Manufacturing PMI (Final, February). Italy Full Year GDP Growth (2025). US ISM Manufacturing PMI (February).

Tuesday – Japan Unemployment Rate (January). Eurozone Inflation Rate (Flash, February).

Wednesday – China NBS Manufacturing PMI (February). Switzerland Inflation Rate (February). Eurozone, US & UK Services PMI (Final, February). Eurozone Unemployment Rate (January). US ISM Services PMI (February), Fed Beige Book.

Thursday – Switzerland Unemployment Rate (February). Eurozone Retail Sales (January). US Challenger Job Cuts (February), Jobless Claims.

Friday – Germany Factory Orders (January). US Non Farm Payrolls (February), Retail Sales (January), Unemployment Rate (February).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more