March 10, 2025

NewsInvestors begin to get back their appetite for Europe

Written as at 6th March 2025

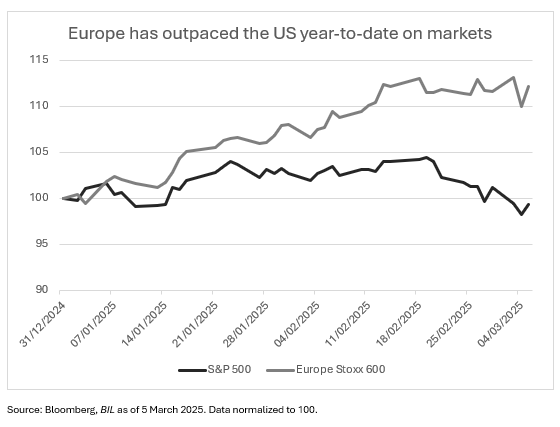

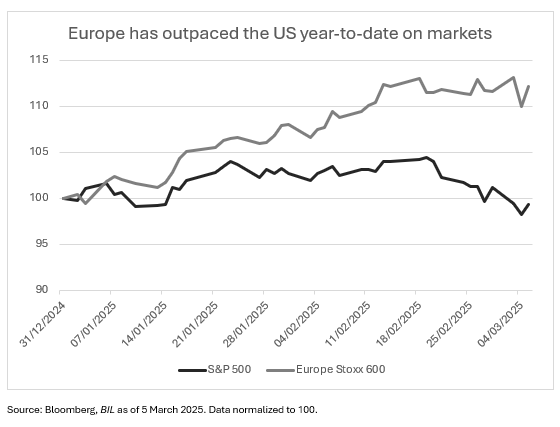

European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600 has risen by around 9% year-to-date, while Germany’s DAX has surged by almost 16%, with both indices hitting new record highs. By contrast, the US market is in the red as at the time of writing.

Several key factors have fueled the remarkable surge in European equities, from emerging signs of economic stabilisation to geopolitical developments…

The US Administration steers away from universal tariffs

A major catalyst behind the rally was the absence of immediate trade tariffs when President Trump initially took office, with Canada, Mexico and China first in line. When it later became clear that Europe had not escaped the radar, markets still found comfort in the White House’s preference for a targeted approach based on “reciprocity”, over broad-brushed universal tariffs.

Given that the EU’s trade tariff differential with the US is just +1.2 percentage points, this proposal would appear manageable. The asterisk, however, is that the Commerce Department may also include non-tariff barriers such as VAT in its calculations. If this happens, Europe could face more sever trade restrictions.

For now, though, markets remain in a wait-and-see mode, carefully trying to distinguish political posturing from concrete policy shifts.

Economic optimism picks up

Also adding to the momentum is the growing sense that economic indicators are bottoming out. Key measures like the ZEW survey, Germany’s IFO Index and the European Commission’s Economic Sentiment gauge, are all showing early signs of recovery. Moreover, a nascent rebound in Manufacturing PMIs suggests that the business cycle may finally have reached its trough.

While these soft data points (surveys) are encouraging, the real test lies in hard data. Industrial production, corporate investment, and consumer spending must follow sentiment higher for a sustained recovery to take hold.

It is also worth noting that Germany, once the Eurozone’s economic powerhouse, is also showing tentative signs of improvement. Its composite PMI has climbed back into expansionary territory after spending much of 2024 in contraction. The recent election outcome has fueled optimism about fiscal stimulus; the incoming coalition does not have time to waste when it comes to revitalising growth.

Geopolitical developments

The war in Ukraine has been a major overhang on European equities for the past three years, prompting many global investors to underweight the region. The prospect of a potential ceasefire initially brought nimble investors back to the market on hopes of lower risk premia for European equities, renewed confidence, and ultimately stronger economic growth. Larger institutional players are only now reconsidering their exposure. If major global asset managers start adopting more of a neutral stance on Europe, that alone could bring a significant wave of money into the market, adding further fuel to the rally.

One sector in particular that has rallied strongly in Europe is defense.

With the US currently refusing security guarantees for Ukraine, the sea change in European fiscal policy could well be a game changer for the bloc.

The risks that could derail Europe’s rally

Despite newfound optimism, several key risks could still disrupt the rally and shake investor confidence.

Firstly, trade remains a wildcard. President Trump has hinted a 25% levy on “cars and all other things”, rekindling fears of a new EU-US trade dispute. If that were to materialise, it could disrupt supply chains, curtail the fragile recovery in European manufacturing, and dent corporate earnings.

When it comes to geopolitics, a peace deal in Ukraine is not guaranteed, and even if it materialises, its economic impact remains uncertain. While some European firms may benefit from Ukraine’s reconstruction, the financial burden could further strain public finances across the EU and siphon money away from investment in infrastructure, digitalization and other value-adding endeavors.

And while the war in Ukraine was the catalyst for Europe’s energy crisis, a peace deal will not make that go away overnight. As of now, it seems Russian energy flows are unlikely to resume fully. European firms could therefore continue to face higher energy costs than their US counterparts, detracting from competitiveness.

Lastly, we can’t forget that the ECB is also still engaged in a delicate balancing act. While markets are pricing in two more rate cuts for this year, the central bank’s easing campaign could still be disrupted. In particular, if the Fed is forced to keep US rates higher for longer, the ECB may have less room to maneuver if it wants to avoid weakening the euro (which in turn could stoke inflation).

Europe: a sweet spot?

While risks remain, the shift in sentiment is undeniable, and if fundamentals continue to improve, European equities may indeed have more room to run.

Only now, are many investors reconsidering their exposure —This, alongside the fact that valuations are still cheap on a relative basis, suggests that further upside remains.

However, for the soufflé to keep rising, we think three key ingredients are required:

- Hard economic data must validate the optimism seen in sentiment surveys

- The ECB must continue lowering interest rates

- Earnings momentum must continue

None of these factors are guaranteed, while a lot of the upside is already baked into prices.

When eating a cake, sometimes we are cautioned “a moment on the lips, a lifetime on the hips”. Investors looking to have a bigger slice of Europe in their portfolio should be thinking about the long-term too, rather than expecting to make quick and easy gains. Timing the perfect entry point is notoriously difficult and the scope for market fluctuations remains quite significant, even if the European economy has really found its bottom.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...

April 2, 2025

BILBoardBILBoard April 2025 – Tariffs, turbul...

Written as at April 1 The first quarter of 2025 was anything but smooth. Market volatility surged, equity markets diverged, bonds offered little in the...

March 28, 2025

Weekly InsightsWeekly Investment Insights

Another week, another set of changes to US trade policy – and that’s before the April 2 deadline where reciprocal tariffs on several trading partners...