Choose Language

March 4, 2021

FocusIs Crypto Becoming Mainstream? | Part I – A refresher

Is crypto becoming mainstream?

Unprecedented trading volumes and dizzying price rallies have sparked a dramatic uptick in interest in cryptocurrencies as of late. No longer perceived as niche technological curiosities, cryptos are now the subject of heated discussion in financial circles and in the boardrooms of world-class companies. In this focus series, we drill down into this relatively new asset class and explore the question on everyone’s lips: Is crypto becoming mainstream?

The series begins with a refresher on what cryptocurrencies and the underlying technology – blockchain - actually are. We will then go on to question whether cryptocurrencies could ever be considered as a viable alternative to money. Thereafter, we will look at cryptos through the lens of a portfolio manager. Finally we will look at what we think the future may hold for cryptos as regulators turn up the heat and central banks enter the fold.

Part I

A Refresher: What are cryptocurrencies?

In 2018, John Oliver, on his famous “Last Week Tonight” show, made an episode on cryptocurrencies. At that time, he described them as “everything we don’t understand about money combined with everything we don’t understand about computers”, while also mentioning that it is always dangerous to make predictions about where tech is going.

Cryptocurrencies have gone from little-known, niche technological curiosities to rapidly proliferating financial instruments that are the subject of intense public interest.

With the media full of stories around crypto entrepreneurs becoming millionaires, not to mention fervour on Reddit and Twitter, short-term investors and speculators are experiencing the FOMO effect (Fear of Missing Out). Crypto obviously had great momentum and accelerated adoption in 2020, like a lot of other things during the pandemic.

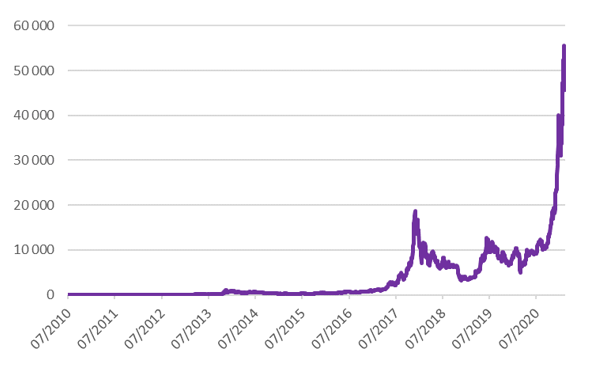

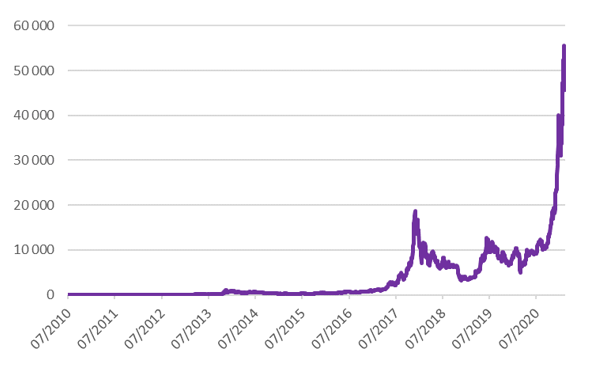

There are many different cryptocurrencies out there that serve different purposes. At its most fundamental level, a cryptocurrency is simply a peer-to-peer digital payment system. The world’s most valuable cryptocurrency is Bitcoin [1]. Bitcoin has extended its 2020 rally, which saw it skyrocket over 300%, into the new year. Following Tesla’s announcement that it bought $1.5 billion worth of bitcoins in February 2021, its price surged to new highs above $50,000. In 2021 alone, up to February 26th, its price is up roughly 58%.

Graph 1: Bitcoin price in USD

Source: Bloomberg, BIL

With some corporates adopting bitcoins and putting those on their balance sheets, we are now observing a reversal of career risk for CFOs and fund managers. Not so long ago, discussing and commenting on cryptocurrencies was unconceivable. It’s now publicly discussed in many areas, from investment strategy to corporate treasury.

The spectrum of views on cryptocurrencies is broad: Some see them as the future of monetary and payment systems that will displace government-backed currencies, others see them as a passing fad with little real value.

Everyone knows something about Bitcoin, but not so many can say what exactly it is. If you are familiar with the main concepts of Bitcoin, you can skip right ahead to Part II of our series.

Bitcoin: What is it? How does it work? What is the point?

The short answer is that Bitcoin is a cryptocurrency or digital asset made secure by cryptography. It appeared in 2009 [2] as a digital decentralized currency, being open source, not controlled by governments, corporations or any individual. Rather, it is a peer-to-peer network powered by its users.

Bitcoin is based on blockchain technology, chaining all historic transactions carried out on the network. In each block we find all transactions by all users over the past 10 minutes. Any transaction carried out in bitcoins is registered in the blockchain; a public record that anyone can download and check. Data is encrypted and while all transactions are visible, the identity of users is hidden. Only the Bitcoin protocol can know exactly who owns what and only when there is a transaction request. The balance of each person’s accounts is never entered as such in the blockchain, only the key provided by a user, known by this person alone, allows this person to check his accounts. The accounts of each user remain anonymous, yet it is impossible to spend money that you do not have.

In blockchain technology, data is not stored in a central server, but across a huge network of computers, which is constantly checking and verifying if the records are accurate. This makes hacking a lot harder, if not impossible. Since Bitcoin came into existence, the entire network has not been hacked. There have been instances of exchanges or wallets being hacked [3], but not the entire network.

Computing power is needed for the blockchain to verify transactions. Instead of having servers, the protocol uses machines from some network members who have requested to be checkers. These verifiers are called miners. In addition to validating data relating to transactions that will form a block, miners - or rather their computers - must solve math problems[4], some sort of computationally-intensive puzzle. The complexity of these problems constantly varies in accordance with the number of miners connected, which makes it possible to maintain a block validation time of close to 10 minutes. It is named the proof of work and it is one of the essential points that secures the blockchain. An extra layer of complexity is that there is also a random variable to ensure that it is not always the same miner who validates all the blocks.

Miners are paid by the protocol in newly-created bitcoins. This is the only way to create new bitcoins.

The amount of new bitcoins released with each mined block is called the "block reward." The block reward is halved every 210,000 block transactions. The last bitcoin halving was in May 2020; at the current pace, the next halving will occur sometime in 2024. [5]

As every block has the identifier of the block below it via an encryption key, all blocks are linked to each other (hence the name blockchain). Modifying a block at any point in the chain, means invalidating all the blogs which are above it. For end users, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet, allowing a user to send and receive bitcoins. Bottom line:

Bitcoin is based on the properties of mathematics rather than relying on physical properties (like gold or silver) or trust in central authorities (fiat currencies).

Bitcoin investors believe that because there is a theoretical cap on the number of bitcoins that can ever be mined, the cryptocurrency will become increasingly valuable at a time when central banks have been printing more money than ever before. That is why some of those investors call bitcoins “digital gold”.

In our next article in the series, we question whether cryptocurrencies could actually serve as an alternative form of money, looking at the key economic functions that money serves: to act as a medium of exchange, a unit of account and a store of value.

Footnotes:

- According to Coinmarketcap.com, bitcoins total value accounts for almost two-thirds of all cryptocurrencies in February 2021

- The Bitcoin whitepaper was published in 2008 by a pseudo-anonymous author named Satoshi Nakamoto. It was the first time ever that somebody put together the ideas of a digital currency and blockchain technology.

- In February 2014, Mt Gox, the largest cryptocurrency exchange at the time, filed for bankruptcy after 744,000 bitcoins were stolen.

- he math problem that these mining computers solve serves no purpose other than to secure Bitcoin's network from attackers wishing to "double spend". Miners receive bitcoin as a reward for verifying "blocks" of transactions on the blockchain.

- At inception, each bitcoin block reward was worth 50 bitcoins. As of February 2021, one block reward was worth 6.25 bitcoins.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

BILBoard January 2025 – Snakes ...

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that...

January 13, 2025

Weekly InsightsWeekly Investment Insights

Looking back on 2024, it was a year marked by conflict and political uncertainty, but it also saw major advances in space exploration, the...

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...