Choose Language

May 22, 2017

NewsItaly’s indebtedness and the imminent need for structural reform

Whilst markets were fixated on the French elections, Italy’s economic and political problems continued simmering. Italy’s public and private sectors are beleaguered by debt and soon Italy’s banks may require fresh capital injections. The debt problem is difficult to swallow in isolation, but there are new risks on the horizon: the country faces general elections in 2018 and the European Central Bank is, at the same time, likely to be underway with some sort of tapering of their Quantitative Easing program – an act which will hurt weaker EU economies, Italy included, the most.

The Italian Economy

Italy is not latching on to the upturn in global economic growth that many other countries have been enjoying. The IMF predicts that the 19-nation Eurozone will grow by 1.7% this year and 1.6% in 2018, yet they expect Italy to grow by only 0.8% both this year and next.

This sluggish growth, alongside consistent ‘fiscal slippage’ and high government debt levels, compelled the rating agency, Fitch, to cut Italy’s sovereign rating to ‘BBB’ (which is the last notch before being considered ‘junk’) in April 2017. The implication of the rate cut is that it increases the pricing pressure on Italy’s debt…

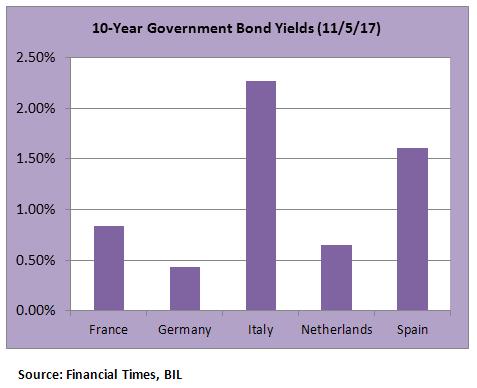

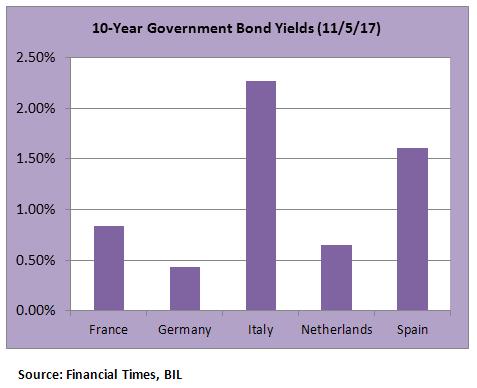

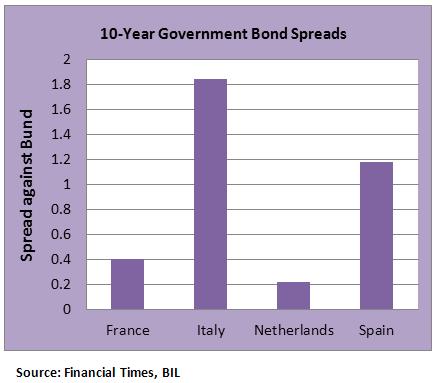

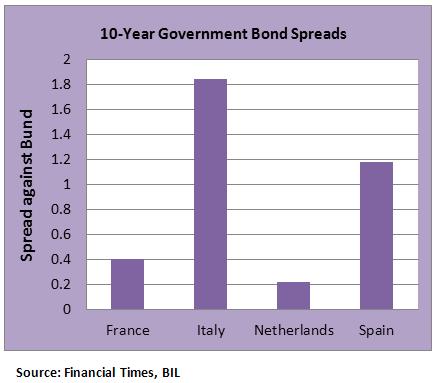

Rising yields

Italy’s leaning tower of public debt sits at 132.6% (some €2100 billion (bn)) of gross domestic product; this is the highest ratio in the Eurozone, after Greece. Italy has more sovereign bonds outstanding than any other Eurozone country and the higher yields go, the more Italy must cough up to bond-holders to service its debt. If perceived risk continues to push yields higher, Italy will become even more entrenched in a circle of debt as more cash is siphoned into debt-servicing, away from wealth-creating activities and investment that could stimulate economic growth. The OECD finds that low levels of public investment, weak innovation and low knowledge-based capital investment are main factors holding back growth in Italy.

One such risk that will push yields higher is tapering of the ECB’s €60 Bn per month bond-buying program, which could begin in January 2018. So far, the ECB has purchased €256 bn worth of Italian government debt, keeping prices high and yields low. There is not sufficient appetite in markets to keep prices elevated after the ECB support diminishes.

Political risk could also put pressure on yields; Italy will have to hold a general election before May 2018. The news distributor Bloomberg comments that the election is unlikely to produce a clear winner and the euro-sceptic Five Star party might gain enough support to form a coalition with the fiercely anti-euro Northern League. Nonetheless, Matteo Renzi, who is a staunch advocate of reforms, has been re-appointed as the Democratic Party (PD) leader and is back in the running.

Reform

In the Financial Times’ 2017 Eurozone economists’ survey, it was noted that the most pressing outstanding reform in the Eurozone was the stock of non-performing loans (NPL) within Italy’s banking system. The problem is so pervasive, that Italy’s banking sector is anchoring the country’s recovery. Some observers estimate that the European Banking system has just below €1 trillion worth of NPLs. Italy’s banking system is exposed to more than €300 bn. If Italian banks fail to clean up their balance sheets, the likelihood that they will need capital injections to survive could increase. However, it seems unlikely that more capital calls by the Italian banking system can be supported without any structural changes.

The OECD states that whilst the government has made significant progress on tackling structural impediments to growth and productivity, Italy must restructure the banking sector to improve governance, raise efficiency, and induce banks to dispose of bad debts so they can restart lending to firms. Innovative start-ups and small-medium enterprises are suffering from reduced access to bank and equity finance.

Italy has initiated a scheme called ‘GACS’ to encourage private investors to invest in packaged loans made up of NPLs by providing a guarantee for the least risky debt. However, uptake has been weak, unlike in Spain and Ireland where non-performing house loans have been successfully packaged and sold to investors. As the think-tank Bruegel points out, in a telling contrast, Spain started cleaning up its banks in 2012 and has enjoyed comparatively dynamic growth since. Spain and Ireland have both benefited from government intervention and the formation of ‘bad banks’ to house all bad debts under one roof. In Italy, no ‘bad bank’ has been established and a lot of hope rests on the ECB and EU to address any NPLs. According to the Bank of Italy, changes to bankruptcy law could help to reduce non-performing loan recovery times significantly.

Other recommendations that the OECD prescribes are;

a better-functioning public administration and judiciary system; a continuation of the implementation of the Jobs Act (a new system of active labour market policies), as well as better training and education to support the encounter between supply and demand in the job market.

Mounting pressure

Whilst there is no panacea for Italy’s woes, the best case scenario at present, is that the current Prime Minister Paolo Gentiloni tries to implement OECD reforms, before 2018 arrives bearing great risk. This could curb investor pessimism and prevent yields climbing upwards.

Perhaps this is the turning point where Italy, faced with pressure from the markets and from the ECB, will enact deep-seated structural reforms, as its Eurozone counterparts have already done. It seems this will be inevitable if Italy wishes to have a place amongst ‘core’ countries in a potential new two-speed Europe, pursuing goals such as banking and fiscal convergence, as they have stated.

The President of the European Commission, Jean-Claude Juncker states "I don't think that one should expect that the problems of the Italian banks should be viewed as unsolvable problems". Indeed, whilst some smaller banks may crumble under the pressure, we expect that in the longer term, some strong, key players could emerge in Italy’s banking sector.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...