Choose Language

April 1, 2020

BILBoardBILBoard March 2020: Patience, discipline and opportunistic portfolio rebalancing

The global economy is in an induced coma and the coronavirus

pandemic will lead to a profound, but not permanent, reduction in economic activity.

2.5 billion people (one-third of the global population) now have some kind of

restriction on their movement as governments attempt to snuff out the virus. The

consequent fall in demand, halted production and severe supply chain disruptions

undoubtedly mean that the global economy is now in recession.

The length of the recession will depend on the course of the

pandemic (epidemiological factors such as when new infections will peak are an

unknown) as well as the policy response. There is no playbook for what’s going

to happen next; nor do we have any comparable historical episodes. However,

China now seems to be approaching the light at the end of the tunnel, and with

the virus having peaked, the cogs of its economy are gradually starting to turn

again.

Our base case scenario sees a government-led ‘Great

Cessation’ spanning Q2, with both supply and demand hitting the rocks. This

could be devastating for the millions of small businesses that form the

backbone of the global economy. A wave of layoffs, missed rental payments and

bankruptcies are likely to follow, even if governments move quickly to bridge the

disruption. But the economic system has a natural adaptive ability: it will

survive. Q2’s deep recession will not result in some kind of economic ice age: once

social distancing is no longer required, the economy will gradually come back

to life. Consumer spending will resume, delayed purchases will be made. Robust

companies will further extend their leadership, while new needs, ideas and

opportunities will erupt.

But in the meantime, markets are struggling to think that

far ahead, with media-induced fear and anxiety steering sentiment. The result

has been a precipitous stock market drop, faster than any other in history.

To calm capital markets and prevent a prolonged recession

and self-fulfilling feedback loop, regulators, governments and central banks are

on the frontline, with some resorting to war-time measures. Monetary

authorities are promising as much liquidity as financial intermediaries and

credit markets want, and the heaviest artillery lines are being reinforced by

massive public and fiscal spending. At the same time, financial institutions

are in a much more robust position than they were in the past, with smaller

balance sheets and high capital buffers, allowing them to offer credit lines to

temporarily cash-strapped companies.

Theoretically, the S&P 500’s valuation has recalibrated

to more attractive levels. The reason we say “theoretically” is because no one

has any idea what earnings will actually be. But eventually, anxiety will

decline and consumption, spending, investment and production will return. Markets will have already rebounded before the recovery shows up

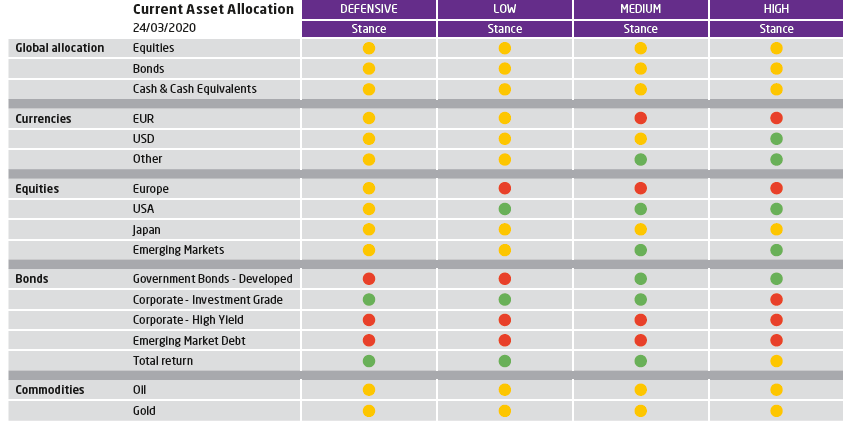

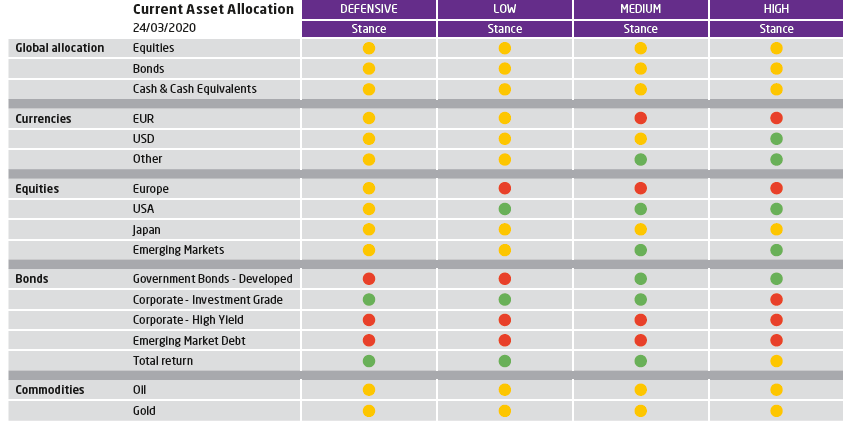

in the macro data. With this in mind, we decided to top up our equity

exposure to rectify the ‘portfolio drift’ effect (the

decline in the market value of stocks naturally meant that they accounted for a

smaller portion of our portfolio than they did before the sell-off), and bring

our overall equity exposure back to neutral. We did so by cherry-picking high-quality names, using fundamental screening

to identify well-poised, high-cash,

low-debt companies generating high levels of free cash flow,

while avoiding sectors/activities at acute risk of disruption in the current

context.

We have also rejigged our sovereign

bond exposure. While the overall allocation to this asset class was held

steady, we increased our euro-hedged US Treasury holdings towards 20% of the

total government bond exposure by selling a proportionate amount of European

government bonds. The primary reason for this is to diversify interest curve

risk: if the situation deteriorates, Treasuries have more room to move

downwards in terms of yield than European equivalents. The best thing to do in

the fixed income world at the moment is to stay safe. Credit spreads have blown

out across all credit tiers; even those on AAA-rated investment grade paper more

than doubled in just ten days, and, if 2008 levels are anything to go by,

spreads could still widen significantly. High yield is basically a no go for

the time being and the new issue market is closed. The segment, in both the US

and Europe, is threatened by a wave of fallen angels (the downgrade of IG bonds

to the junk category), while the US high yield space looks even more febrile

when you consider its close correlation with the oil price (due to the presence

of many shale-producing firms). For now, Saudi Arabia’s price war persists, which

last week caused crude to dip below $25 per barrel.

With so many moving parts, it is true

that things may get worse before they get better. However, we should stay

focused on long-term investment objectives, reassured that with so much fiscal

and monetary firepower being brought to the table, this is not the beginning of

the end. The majority of blue chip companies and household names will survive

this.

For now, the best thing we can do is play our part in “flattening the curve” and getting this disease under wraps by staying at home if possible, while implementing social distancing and near-obsessional hygiene. If in need of something to watch and/or reassurance, the new Netflix series “Night on Earth” is a solid pick. Using the latest camera technology, it lifts night's veil to reveal the hidden lives of the world's creatures after dark. A reassuring anecdote comes from the arctic frog. These tiny amphibians are captured surviving almost completely frozen, to the point where they stop breathing and their hearts stop beating entirely for weeks at a time. But when warmer weather comes, the frogs are shown miraculously defrosting and coming back to life – let’s think of the economy like an arctic frog.

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....