Choose Language

August 6, 2018

NewsQ2 earnings underline the strength of corporate America

Originally published I the Luxemburger Wort on 4/8/18.

Next week, earnings will continue to be a focal point for investors. At the time of print, over 60% of companies in the S&P 500 had reported their earnings results for the second quarter (Q2) of 2018. So far, this earnings season has been testament to the health of corporate America as Republican tax cuts continue to stoke the economy.

To date, the aggregate earnings growth for the S&P 500 is just shy of 25% with a +5.25% surprise (relative to analyst estimates). If this is the final growth rate, this will mark the second highest pace of growth since Q3 2010 (34.1%). Sales growth is sitting around 10% with a surprise of +1.2%.

In terms of sectors, Energy is the star of the show with earnings growth greater than 100% and sales growth above 20%. Success has derived from a +40% increase in the oil price - according to FactSet, the average price of oil in Q2 2018 was $67.91 vis-à-vis $48.15 in Q2 2017.

Contrary to what may be assumed given some of the headlines that big tech names have elicited as of late, the IT sector has also delivered robust Q2 results with aggregate earnings growth of over 40% and sales growth of around 17%. Some high profile stocks have, however, suffered nosediving share prices as investors became unnerved by company guidance that envisaged tighter margins moving forward.

Another thing which has become apparent during this earnings season is that corporate America, on the whole, has not yet felt significant pain from the US’ ongoing trade spat with various trading partners. FactSet scanned company earnings calls for any mention of the word ‘tariffs’. 70 companies discussed tariffs on their calls, but the majority of these (61%) saw little to no impact on their earnings in Q2 or anticipated little to no impact in future quarters from tariffs. The Industrials sector has witnessed the highest number of companies discussing “tariffs” on earnings calls.

From the onset we have resisted any urge to react to headlines and rather, we have stayed fixated upon hard data and fundamentals, managing risk based on known information rather than on threats (which at times did not materialise) and assumptions. This has proven to be beneficial for our portfolios.

Looking ahead

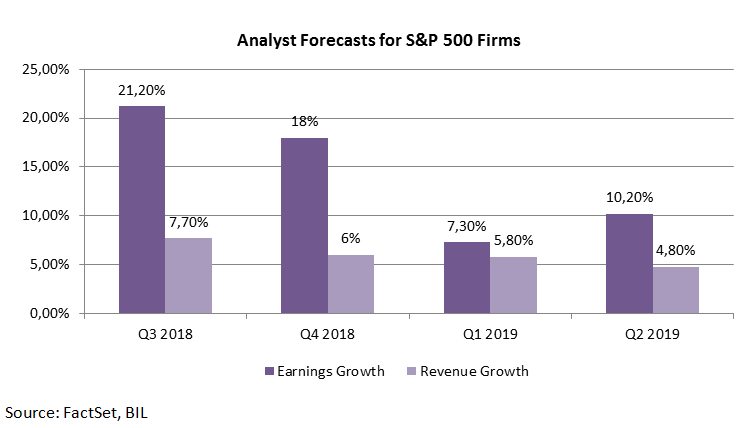

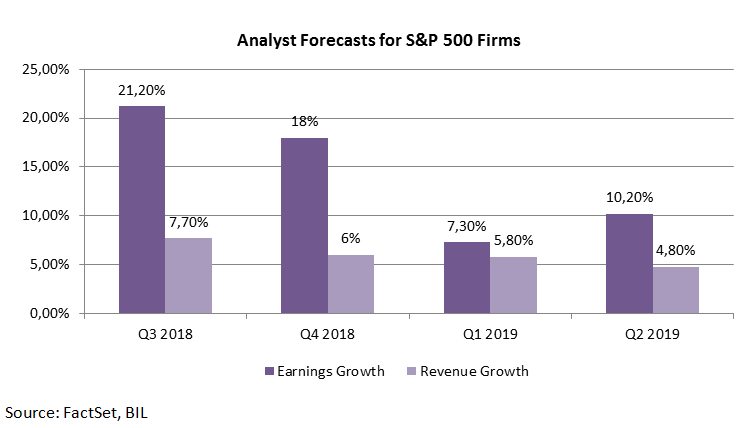

Analysts project that earnings growth will continue at a pace of around 20% through the remainder 2018, before slowing in the first half of 2019.

If their predictions are accurate, 2018 is poised to be a fine vintage in terms of earnings. Our portfolios are quite heavily skewed towards US equities at the moment in order to benefit from the burgeoning US economy and strong earnings whilst they persist. Not only are earnings themselves key, but also how the market reacts to them. Fortunately for our tactical bets, FactSet finds that the market is rewarding positive earnings surprises more than average and punishing negative earnings surprises less than average at the moment.

However, this is not to say that equity investors will have a smooth ride over the coming weeks. It’s prudent to note that the month of August has historically been choppy month in markets. Further still, in years when US midterm elections are scheduled for September (as they are this year) the S&P 500 has been 34% percent more volatile in the August. Albeit, our base case is for further upside in equities this year, though some setbacks can be expected along the way.

Data source: FactSet, Bloomberg

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...