Choose Language

August 1, 2019

FocusThe Future of the Automotive Industry: Part III

The Future of the European Automotive Industry

Trends, challenges, risks and opportunities from an equity market perspective

Interview with Lars Mogeltoft and Arman Arshakyan

In an extensive interview, we spoke to Lars Mogeltoft, Head of Equity, and Arman Arshakyan, Equity Associate, in order to gauge what is happening inside of the European car industry.

The first in the three part series set the scene, detailing the current state of the industry and the key trends shaping the landscape. It also outlined the vital role that this sector plays within the European economy.

The second part delved deeper into the challenges faced by automakers.

And now, in the last of the set, we will tie all of this up and assess what it means for equities.

Part III: Implications for equities

So in the last section, you outlined the various challenges faced by European automakers, and indeed the situation seems to be pretty ominous. What has this meant for their shares?

The Automobiles & Parts Index was the second-worst performer in the Stoxx 600 index in 2018 as the transition to electric vehicles, the move away from diesel, forex and tariffs hit margins, causing earnings to decline from their 2017 peak.

Since the start of 2019, the sector has lagged the broad market, but to a lesser extent than in 2018.

What could act as catalyst for a revival, if any?

Perhaps consolidation as called for by the late Fiat chief executive Sergio Marchionne...

He was quoted as saying: “We have failed collectively as an industry to deliver value commensurate with the level of capital that is being consumed… Consolidation is the only key to remedying the problem in the short term.”

Already we are seeing collaboration in the area of autonomous driving, for example the Argo AI start-up initially sponsored by Ford, has become a 50/50 joint venture (JV) with VW, with Ford gaining access to VW’s electric vehicle platform. This may just be the beginning, because once such operations start to become profitable, M&A is likely to supersede JV activity. The JV is like the engagement, M&A is the marriage once profitability is proven.

However, it is not always straightforward as we saw when the Fiat Chrysler/ Renault merger fell through (largely because of insistence from the French government for the Nissan alliance to continue). This came as a clear reminder that change is complicated for traditional car makers.

But what about the example of VW, who confirmed it would shed its truck division before the summer as part of a broader disposal program of non-core assets?

This should be thought of as a spin-off, with the company doubling down on its core operations.

And what about consolidation in China?

There were about 100 car manufacturers and now Beijing is pushing the idea of ‘quality not quantity’. However, this is more driven by the demand side, with consumers favouring smaller cars and SUVs produced by foreign companies.

Company guidance and consensus estimates for 2019 seem to be heavily back-end loaded, assuming a notable bounce back in sales and production in the second half of the year. Should this worry us?

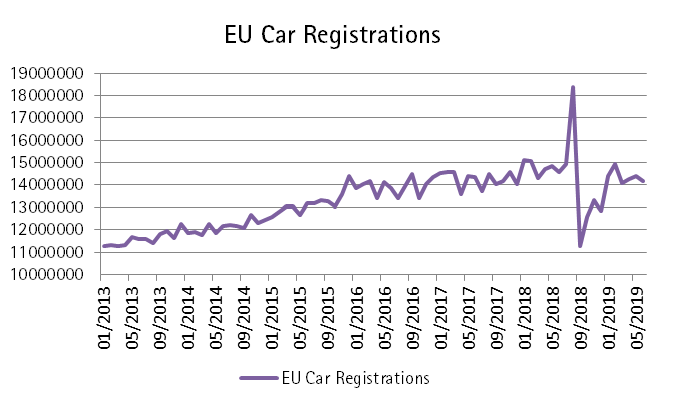

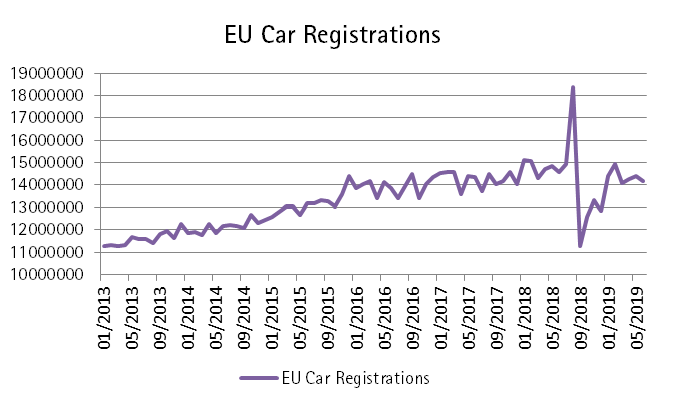

Every time ROE in the car industry is lower than the market average, the stocks under-perform, no matter how cheap they are. It’s important to keep in mind that in August 2018, car registrations in Europe got an artificial boost from the implementation of the new WLTP test that was applicable on all new cars from 1st September 2018. This led most manufacturers to offer pre-WLTP vehicles at huge discounts. This is visible in the incredible sales volumes recorded in August 2018, quickly followed by a sharp reversal the following month and since then, some sort of normalization. Hopes of a notable bounce back in sales have been dashed, but a positive base effect will kick-in from Q4 2019 in Europe. The same is currently true for China, where we will need to stay patient to get a better understanding of registration trends (with current figures skewed by the onset of regulation).

Are car manufacturers cheap?

Car manufactures are trading at a 15 year low (in terms of valuation) against the market, around a 30% discount to the overall market on P/E metrics.

Fundamentally they look in OK shape: They have a high free cash flow yield, their balance sheets are the strongest they have been for 2 decades and they have a relatively high ROE.

However, though they are cheap, there is a lot of risk and their valuation implies that investors are nervous about the current and future profitability. The industry is extremely capital intensive and R&D costs as well as increasing regulation are putting pressure on margins. At the same time, sales volumes are not going up, compelling them to offer incentives. Historically the shining margins of BMW (around 10-12%) are under siege and expected to go down to around 6-8% this year.

As long as relative earnings revisions are lower than those of the broader market, we should not expect any out-performance, no matter how cheap auto firms are. Valuations give some kind of bottom, but the trigger for out-performance will be if relative earnings revisions begin to go up again.

What about part markers?

Auto part makers are worth almost double car manufacturers. This is because they are not subject to the same risks and price pressures. If the economic cycle turns, people may hold off buying cars, but there will always be a demand for things like tyres – they are therefore less exposed to the trade war. Car manufacturers also have to compete with the second-hand car market.

This explains why part makers are more expensive in terms of valuations. We would give preference to them but acknowledge that at some point, the spread in valuations between auto producers and part makers will have to narrow.

So, is the sector cheap or simply too dangerous ?

Over the long term, we still expect growth, despite structural challenges. Keep in mind that the average vehicle age is around 11 years in both Europe and the US. So even mature markets can still offer structural growth

Recent results from BMW (first loss in a decade in its main automotive division) and Daimler (fourth consecutive profit warning in just over a year) are clear illustrations of the challenges facing the industry.

European car registrations fell sharply in June. While the industry group blamed this on ‘fewer working days during the month’, the weak showing adds to the gloom enveloping the sector, with year-to-date demand down 3%. The European industry association already revised its prediction for the full year 2019 and expect to see a 1% drop in vehicle registrations.

Valuations are appealing but a catalyst for being positive the sector is needed. This could take the form of a settlement being reached in the trade dispute, or a confirmation of the anticipated positive base effect in car registrations expected for Q4 2019.

What companies offer a reasonable risk/reward ?

We prefer firms that are primarily exposed to the European market and as such, are less sensitive to tariff risks. We also keep an eye out for companies that are pursuing successful acquisitions, selecting companies strategically, making sure that they fit nicely into their existing operations.

- https://www.acea.be/uploads/publications/ACEA_Pocket_Guide_2018-2019.pdf

- https://home.kpmg/be/en/home/insights/2019/01/the-future-of-the-automobile-industry.html

- http://www.german-times.com/the-automotive-industry-is-facing-major-challenges-around-the-world-german-carmakers-have-more-to-lose-than-most-and-are-thus-investing-a-great-deal-in-securing-its-future/

- https://www.astutesolutions.com/industry-insights/automotive-industry

- https://www.economist.com/leaders/2017/04/06/the-perilous-politics-of-parking

- https://www.candriam.lu/en/professional/market-insights/topics/sri/long-live-our-batteries/

- https://www.scmp.com/news/china/economy/article/2088876/chinas-more-300-million-vehicles-drive-pollution-congestion

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...