Choose Language

November 7, 2024

NewsThe impact of the US election

The results of the US presidential election have been made clear, with Donald Trump elected as the President of the United States for the second time. Even before all the votes were counted, the dollar climbed higher against a basket of currencies as it surged to a two-year high, and bitcoin and US bond yields jumped as investors placed their bets on Trump. In Europe, the Euro fell against the Dollar and government bond yields fell sharply in anticipation of Trump's promised trade tariffs. German two-year bond yields also fell.

As the cloud of uncertainty surrounding the outcome of the election begins to lift, we expect market volatility to ease as the dust settles.

What can we expect?

Trump campaigned on low taxes, low regulation, low energy costs and higher trade tariffs. Potential beneficiaries of his victory according to market participants could include oil majors, financials, prison operators, utilities, and companies with a predominantly domestic focus. While lower taxes and regulation would be welcomed by Wall Street, it remains questionable whether President Trump will be able to further reduce corporate taxes, which were already cut during his previous presidency.

The tax cuts promised in Trump's election campaign could significantly increase the budget deficit. According to the new president, the tax cuts should be offset by major new trade tariffs, but economists are not convinced and instead expect Trump's protectionist policies to boost inflation.

For Europe, the proposed trade tariffs could severely damage international relations and supply chains, as the US accounts for around 20% of EU exports. Germany is particularly vulnerable to the proposed 100% tariff on all cars imported into the US. This could also have a significant impact on exchange rates. The Euro fell against the Dollar on the news of Trump’s victory, as Europe anticipates a harsher trade environment. It remains to be seen, however, when and if the proposed tariffs will be implemented and whether the European Commission will decide to reciprocate with tariffs of its own.

Our approach

While politics can and will create noise in the medium-term, we expect economic fundamentals to be the main market driver in the long-term. Trump's stated policies may impact specific industries or the broader economy, however, the implementation and consequences of these policies will not necessarily be as predicted. We will therefore be cautious in implementing structural changes based on election’s promises.

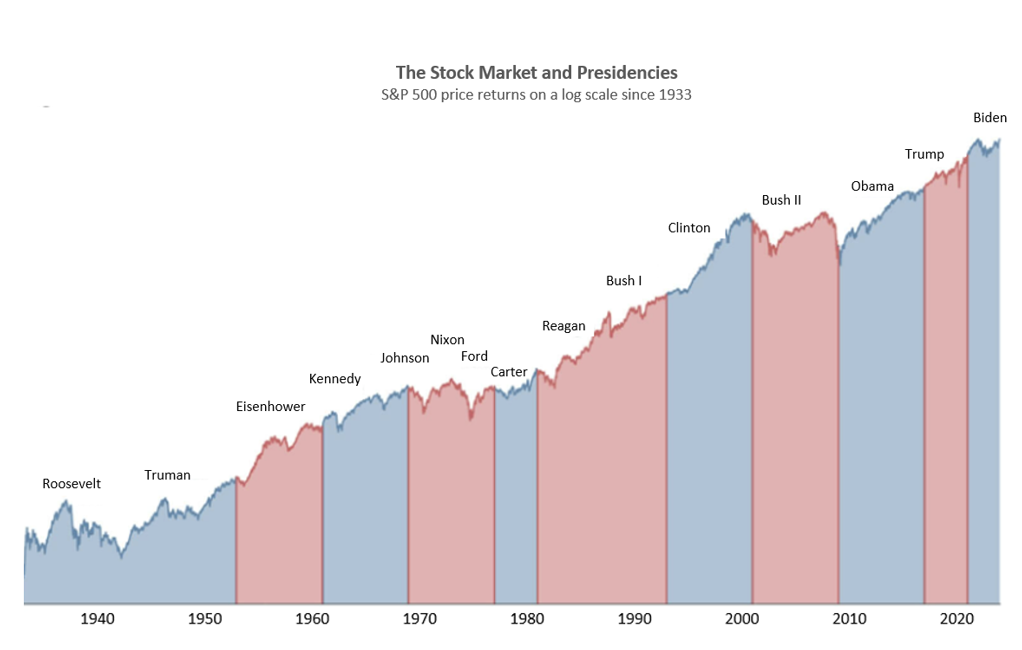

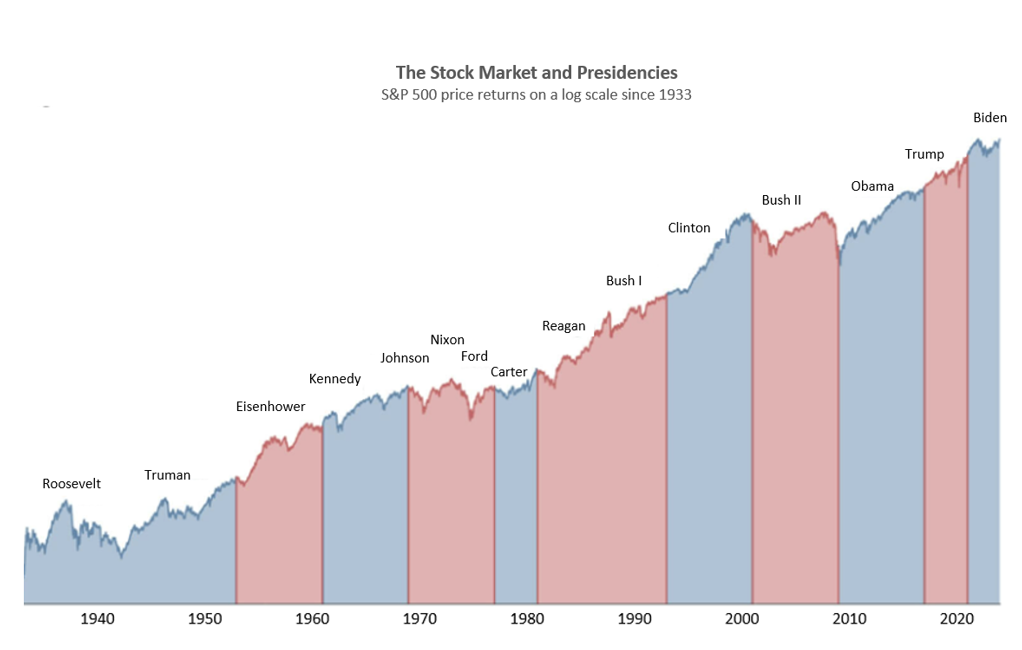

Across history, the S&P 500 has averaged double-digit gains whether Democrats or Republicans are in the White House, thanks to the powerful force of compounding.

Source: Bloomberg, BIL. Up until Dec 31, 2023.

Past performance is not indicative of future returns. This should not be considered a recommendation to buy or sell any security. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly.

For now, we are maintaining our allocation, favouring US equities (which benefit from stronger fundamentals), with a bias towards smaller capitalisation companies, which should benefit from more protectionist policies. Our fixed income exposure is concentrated in European government and corporate bonds, with a limited position in US high yield. In the short term, we will monitor the evolution of the USD, which could benefit from the expectation of a more inflationary policy in the US.

Once we have clarity on future measures and their concrete impact on the economy and companies, we will continue to adjust our positioning.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 10, 2025

Weekly InsightsWeekly Investment Insights

US equities ended lower last week, amid tariff uncertainty stemming from the Trump administration. While proposed tariffs on Canada and Mexico were postponed for...

February 3, 2025

Weekly InsightsWeekly Investment Insights

By Friday, it seemed as though a volatile week for stocks had ended on a positive note. The damage caused after Chinese AI app DeepSeek...

January 28, 2025

NewsNavigating Europe’s Demographic...

Europe faces a multitude of structural challenges that threaten its economic stability and future growth. In addition to the ongoing malaise in manufacturing, political...

January 27, 2025

Weekly InsightsWeekly Investment Insights

Last week, world leaders gathered in Davos for the annual five-day meeting of the World Economic Forum. On the agenda were geopolitics, US-EU-China relations,...