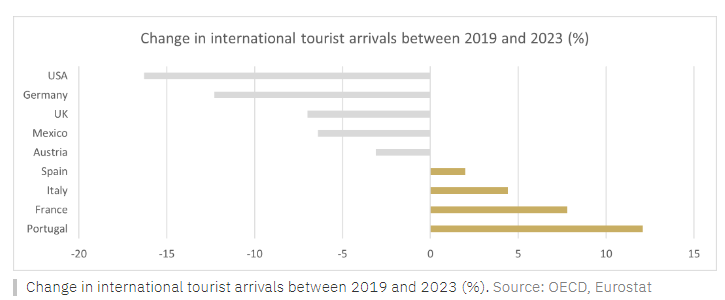

In 2022 and 2023, spending on tourism worldwide grew at a rate seven times faster than GDP growth. In the wake of the lifting of restrictions linked to the covid-19 pandemic, researchers have observed a readjustment in household behaviour with regard to leisure spending around the world. The desire to enjoy the moment has taken hold, and despite elevated inflation, the appetite for travel continues to grow.

A windfall for (southern) Europe

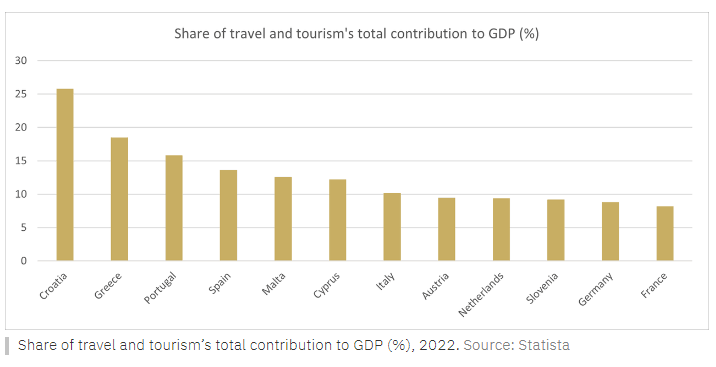

Though it is home to just 5% of the world’s population, the EU accounted for almost a third of international tourism spending in 2023. In terms of season, summer takes the lion’s share, with almost half of annual arrivals. Geographically, southern Europe, with its advantages in terms of climate, culture and geography, attracts the largest number of visitors.

Beyond the beauty of Europe and the blue of the Mediterranean Sea, there are a number of major factors reinforcing this trend.

Firstly, the strength of the US dollar, rising stock markets and the powerful post-covid recovery have so far enabled millions of Americans to embark on European adventures. Although household balance sheets are beginning to tighten, a recent Bankrate survey found that around a third of Americans plan to finance their summer holidays on credit this year.

But demand is also coming from within the EU. 75% of Europeans plan to travel between May and October 2024. However, the Europ Assistance/Ipsos 2024 Holiday Barometer reveals that to mitigate the effects of inflation, 45% of Europeans will opt for a destination closer to home (to the detriment of long-haul travel). The survey also reveals that 49% of Europeans plan to travel by car, out of convenience and habit. 44% will take the plane and 17% the train. One in four people say they want to travel by train for reasons of sustainability. 67% of Europeans said they would travel to a closer destination in order to reduce their carbon footprint.

Given these strong tailwinds, forecasts predict a total of €742.8bn will be spent on travel in Europe this year, an increase of 14.3% compared to 2023. Business surveys show that tourism is set to remain an important growth driver over the coming months, with the services sector underpinning the recovery in the eurozone.

In the short term, therefore, the outlook is very promising for the flagship destinations concentrated in southern Europe, and governments are working hard to capitalise on this dynamic. Locally, tourism is creating thousands of jobs and stimulating growth. In Spain, for example, one in four new jobs is linked to tourism. In Greece, a rising star since the pandemic, tourism accounts for more than a quarter of economic output and the annual income of nearly two million Greeks comes from the sector.

In the eurozone, the tourism-driven economies of the south are holding their own, while the manufacturing sector is in the doldrums. This economic diversification is a blessing for the EU as a whole, as it has helped to avoid a deeper recession and is now encouraging a slight recovery, even in the absence of the traditional locomotive of growth, Germany.