Choose Language

March 31, 2021

FocusTransportation and energy: A silent revolution

Maybe trivial, but also demonstrative that environmental awareness is at the very top of global awareness, I recently read that Sir David Attenborough, the naturalist and broadcaster, broke, at the age of 94, the world record for the fastest time to reach 1 million followers on Instagram [1]. The previous record holder was the actress Jennifer Aniston. This is not yet a trigger for me to join the platform, but it is reassuring to see that world’s top influencers are not only fashion aficionados, football players, Hollywood movie stars or musicians.

In a recent interview, the futurist Ramez Naam[2] said that “We are in a race between how rapidly we’re doing damage, how rapidly we are emitting carbon dioxide, hitting 450 parts per million in the atmosphere and that 2-degree limit versus how rapidly we can innovate and deploy the new technologies. We are currently not winning. But the good news is that every year solar, wind, batteries and electric vehicles (EV) get cheaper. It is a positive feedback loop, and so I’m hopeful that every year we can try to push harder and faster.”

Transportation and energy are the two key sectors in terms of the sustainable energy transition. Today, more than 16% of the world’s greenhouse gas emissions come from transportation (mostly twice as much for developed countries).

Some of the best minds of their time created the trains, cars, planes, and ships that fueled the industrial revolution and transformed human abilities. With a few technological improvements over time, these same modes of transport and travel still underpin the global economy today. Whilst these forms of transport are more efficient than when they were invented, we still need massive changes in how we move people and things.

To respond to the climate challenge, the mobility sector has no choice but to reinvent itself. The road to a decarbonised transport sector is, nevertheless, long and winding. What’s clear is that the days of internal combustion engines for ground transport are numbered. It’s about time that we had a revolution in the technology that powers our transport. If 2020 was the year of immobility for most of us, let’s act so that 2021 is the year of electric mobility.

With the meteoric growth of Tesla’s equity price in 2020, its market capitalization reached as much as the combined market cap of the nine largest car companies globally. It is amazing to observe that a relatively new entrant to the car market could become the most valuable car company in such a short space of time. If you add the fact that, in 2020, Exxon Mobil was ejected from the Dow Jones index and observe the excitement around hydrogen, we should not be too far away from a future in which tailpipes only emit water vapor.

Announcements about the phasing out of internal combustion engines are clearly logical. This is one of the two most important parts of the general fossil fuel phase-out process (the other being the phase-out of fossil fuel power plants for electricity generation). More than 14 countries and over 30 cities around the world have proposed banning the sale of passenger vehicles (primarily cars and buses) powered by fossil fuels such as petrol, liquefied petroleum gas and diesel mostly by 2030 and 2040.

To speed up the shift towards low-CO2 vehicles, governments around the world are following a carrot-and-stick approach – by offering subsidies to cushion the hit to automakers’ margins, as well as announcing plans to ban future sales of new vehicles with internal combustion engines. But we are not naïve, the reality is also that most countries proposing a total ban on the sales of internal combustion engines either have a small auto markets or a very clean electricity grid, or both.

The same logic is visible inside the industry with many companies pledging to only manufacture electric vehicles within couple of years. To gauge what is real strategy vs. fictional marketing is hazardous. Electric vehicles are cheaper to operate than their internal combustion counterparts, but at this point, more expensive to produce. Such a shift will bring headwinds for some manufacturers and opportunities for others.

This is valid as well for consumers. Many people still have concerns about buying a fully electric car, including the price of the car, charging times, charging points, and how green they are:

- Fully electric cars are often more expensive and much of that has to do with the price of the battery itself (around 20 to 30% of the cost of an electric vehicle). Battery prices are expected to fall and so the price of a new car should fall significantly over the next few years, hopefully bringing the cost down to a level comparable with petrol and diesel vehicles.

- Currently, charging a car can take anything from 30 minutes to over 24 hours, depending on the size of the battery, the type of car, and the charging point you are using. These times will almost certainly be reduced in the future.

- Where you charge your car can also be a big worry. Easily accessible public charging locations are vital. Public charging plugs have hit the one million mark around the world and industry figures show the EU had more than 224,000 public charging points in 2020. According to the European Automobile Manufacturers’ Association (ACEA), the EU should set binding targets for one million public charging points for EV by 2024, and three million by 2029, to give consumers the confidence to switch to the technology.

- Electric vehicles themselves do not directly pump out harmful carbon emissions, but they do have other environmental costs such as mining the minerals for batteries, manufacturing them, and recycling them. For sceptics, a 2020 study from Eindhoven University of Technology showed that the manufacturing emissions of batteries of new electric cars are much smaller than previously assumed, and that the lifespan of lithium batteries is also much longer than had been thought. As such, they are more ecological than internal combustion cars powered by diesel or petrol. Finally, the electricity to charge the EV needs to come from non-fossil sources.

Which energy options are the most efficient?

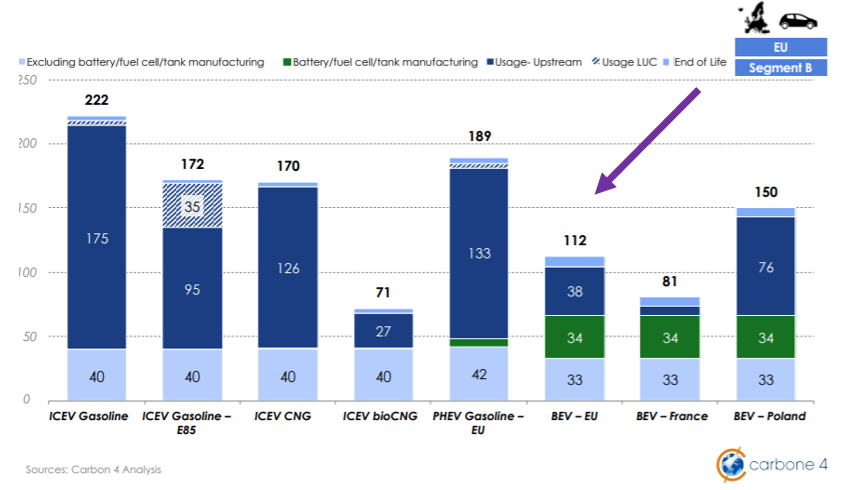

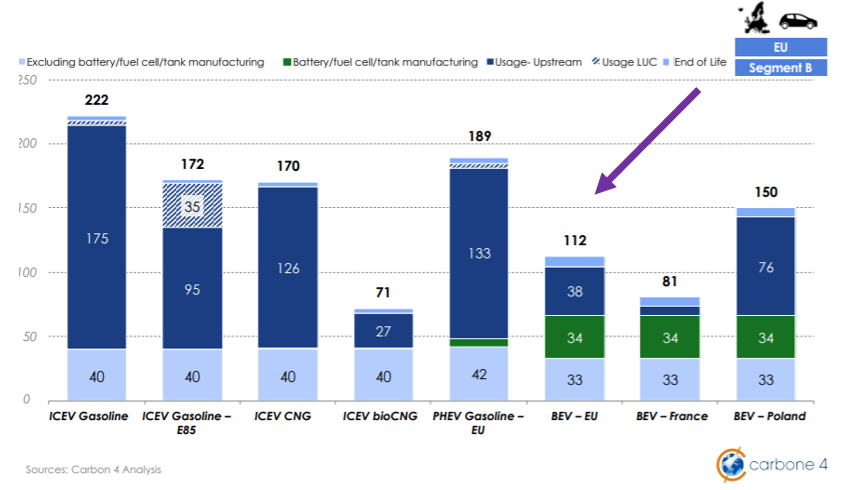

When choosing a vehicle, to rank the different available energy options, one of the main metrics to compare is the carbon footprint over its life cycle, considering manufacture, use and end of life, for all greenhouse gases. According to Carbone 4[3], battery-run electric vehicles, whatever the electric mix of the region under consideration, reduced the carbon footprint by 50% to 70%, compared to fossil-fueled vehicles, despite the battery’s manufacture and recycling processes. This relatively new finding is due to the mass production of batteries for electromobility (making it possible to significantly reduce their carbon footprint per unit (scale effect)), and the electricity mix of all European countries being gradually decarbonized. Vehicles running on biogas have the lowest carbon footprint, thanks to the very low emission factor of biomethane. However, the biomethane resource is limited, and it is better to reserve it for other uses.

Average carbon footprint over the lifetime of a car sold in 2020 Europe – Segment B | gCO2e/km

Glossary: ICEV (internal combustion engine vehicle), PHEV (Plug-in hybrid electric vehicle), BEV (battery electric vehicle), NGV/CNG/LNG (Natural gas for vehicle/ compressed/ liquified)

Technologies are improving, making batteries more efficient, with greater capacity and with a longer life. There are major benefits to the local environment of having non-polluting electric cars replacing the traditional internal combustion engine.

If you are thinking of buying an electric car today, there are certainly challenges, depending on where you live and where you drive. But with growing awareness of the environmental damage done by fossil combustion engines, many vehicle manufacturers have focused their attention on developing electric powered cars. That will surely bring prices further down and encourage all of us to consider the benefits of greener electric vehicles.

EV skeptics argue that current EV penetration is low. This is true. But the reality is also that if current sales volume of electric vehicle represents around 10% of all sales, it is growing exponentially and not linearly. Reaching 50% or 60% at the 2030 horizon is not a fantasy, especially with the view that European automakers would optimize their EV/Combustion mix to meet regulatory standards, while catering to consumer preferences. According to IHS Markit, global electric vehicles are expected to grow by 70% this year. Just looking at Germany, sales of EVs tripled in one year in 2020.

We have always thought clean energy would be more expensive than dirty energy. But now it looks like clean energy will be the cheapest energy. The energy transition will be a long process. It will not be done overnight, but we really have hit that point. The cost of electricity from solar power has dropped by a factor of 30. The cost of shifting from wind power is down by a factor of 10, and that is what is disruptive to fossil fuels. But clearly, every year solar and wind and batteries and electric vehicles get cheaper. This trend is transforming the energy industry.

Building energy storage facilities is still a key factor. Balancing intermittent and seasonal resources of wind and solar with smart grids, in which EVs have a role to play, is a reasonable part of the solutions.

We also need to understand that EVs are much more than vehicles. They are basically batteries on wheels. Connecting those batteries to buildings, homes, and offices can offer energy supply or energy storage. The bi-directional flow of electricity between storage points and electricity usage offers exponential applications.

This brings me to the current headlines on financial markets: Volkswagen is coming for Tesla’s electric vehicle crown. While Tesla has been a trailblazer in the electric vehicle space, legacy car companies have been laggards to date. That is about to change according to some automobile specialists. One automaker everyone is hoping lives up to its promises is Volkswagen. According to some observers, the German automaker's all-electric SUV could be a real threat to Tesla’s model Y. Who knowns? I do not. What I know is that VW overtook SAP as Germany’s most valuable public company after the announcement of their plan to become the world’s leader in electric vehicles mid-March. If, as a company, you do not act rapidly, your competitors will not ask your permission to embrace these new technologies and disrupt you. It’s therefore not a surprise that Daimler is halting all its development of internal combustion engines.

So, the only answer for someone in an industry where technology is rapidly disrupting is to embrace that technology and to disrupt yourself, rather than let a competitor disrupt you.

The Role of China

Would the disruptor be disrupted by historical incumbents or could it be that some Chinese pioneers are going to take the lead? What is granted is that China is the largest automobile market in the world, both in terms of demand and supply.

The Chinese car giant Geely (the owner of Volvo Cars) is probably the most well-known, being the country’s biggest private carmaker (mostly lower-to-mid-market segment). The company just unveiled a new electric car brand called Zeekr, which is intended to take on Tesla in the premium market - and set to expand globally in the future.

NIO is another company that could well be a disruptor. After nearing bankruptcy in 2019, NIO is now considered as the rising star of the Chinese auto market. NIO’s business model is centered around premium/luxury EVs. It also offers batteries that are ‘chargeable, swappable, and upgradeable’ (to longer range). By subscribing to the company’s “battery-as-a-service” plan, you can access battery swap stations where your battery will be replaced with a fully charged one in 5 minutes. Tesla dropped the same battery swap project in 2015, choosing to build more superchargers across the world instead (75 minutes to fully charge a car). By choosing to standardize the battery for all models, NIO is also offering customers a 20% discount when buying their cars without a battery. Knowing that battery swap technology is part of the Chinese authorities’ annual policy blueprint, we should not be surprised to observe larger adoption.

Let me be honest, I’m not an expert on automobiles. What I know is that I am using a car to move from point A to point B. While some of us still have some sentimental value attached to a specific brand, I personally do not, and I am pleased to see younger generations keener to adopt new consumption patterns around autos or more broadly around transportation. The idea of transport as a service and its access will probably be more relevant in the future than car ownership. What I take for granted is that the world is moving towards sustainable fuels and being environmentally friendly. And it’s going to be electric because that’s the cheapest cost per kilometer. A big detox[4] of transportation is possible.

To reach scale and speed, we will need clever combinations of finance and policy. But clearly, the end of the combustion engine is within sight. Companies and consumers are increasingly seeing that there are a lot of benefits associated with EVs. It is not just environmental benefits, EVs are also offering significant fuel and maintenance cost savings.

The question is no longer whether this will happen but when. It will depend on us and the choices that we make this decade. A future without tailpipes, a future with a thriving economy and clean air, a future we choose for the climate and for our health.

Formula E

Knowing that motorsport has always been a laboratory[5] for road cars, a green version of automobile sport is also forthcoming. Technology being developed within Formula E[6] - one of the world’s newest and most exciting motorsports – is impacting the cars on our roads. Not only will Formula E continue to develop the technology that we see in our road cars, but it is starting to change perceptions of electric vehicles too. This is showing people that electric cars are not boring or slow. As more and more electric racing series pop up, we are going to see more people come around to the idea of this electric future.

Formula E’s goal is clear; to promote the uptake of electric mobility and renewable energy solutions in major cities around the world. While F1 currently stages Grand Prix in 21 different countries (compared to the 12 countries that hosted an E-Prix last season), Formula E travels only to densely populated cities that are actively fighting to counteract climate change and reduce air pollution. By helping to accelerate the adoption of electric vehicles in these locations, Formula E has attracted some of the largest car manufacturers in the world, including the likes of Audi, BMW, DS, Jaguar, Mercedes, Nissan, and Porsche. Not bad for a series less than six years old! So why, with the exception of Mercedes who compete in both, are these manufacturers focused solely on Formula E rather than chasing the exponentially larger global reach offered by F1. The answer to that is simple. In modern motorsport, and in the car industry generally, major manufacturers are no longer able to comfortably justify the enormous R&D costs required to compete in F1 when the future road relevance of the product they are producing is fairly limited.

While all cars may look the same, Formula E is not a spec series, where all drivers race the same model of car. Although visually the cars appear similar, this is simply because the chassis itself is homologated. The teams instead focus their R&D efforts on developing other parts of the car such as the powertrain, gearbox, and suspension, and it is these elements, along with some incredibly advanced software, that sets one car apart from another in terms of performance.

The first comparison people tend to look for is speed, and while Formula E cars do accelerate at a similar rate to F1 cars, their top speed peaks at around 280km/h, roughly 70km/h less. Until as recently as season four (2017-18), Formula E drivers were unable to complete a full race distance without needing to stop to change cars halfway through the race. Advancements in battery technology mean that the drivers now have double the amount of usable energy as they did previously, making pitstops a thing of the past.

A reasonable expectation could be that in the future, Formula 1 becomes some sort of classic car race, equivalent to horse racing or iconic technology museum collections.

Sir David Attenborough has been preaching about the effect of humanity on the environment for decades. I believe that driving an electrical car is becoming some sort of status symbol. What is clear for me is that after reigning in the auto industry as the powertrain of choice for a century, the internal combustion engine is dying. Smart companies are investing and innovating in response to that demand. We all have a role to play to participate in the transformation of our transportation systems, but the fundamental question of whether we will be moving beyond petroleum, I think, has been settled.

Considering that more people watch sports than environmental documentaries, Formula E demonstrates that tackling climate change does not have to be sad and boring. “Humans are competitive animals, and the race to zero emissions is the only race that we have to win or lose together. But there is some competition within it, and that definitely attracts people.”[7]

References:

- Source : https://www.guinnessworldrecords.com/news/2020/9/sir-david-attenborough-breaks-instagram-record-for-fastest-time-to-reach-one-mill-632391

- Ramez Naam is an American technologist and science-fiction writer. He is best known as the author of the Nexus Trilogy. Naam was a computer scientist at Microsoft for 13 years, and led teams working on Outlook, Internet Explorer, and Bing. Naam is also an Adjunct Professor at Singularity University, where he lectures on energy, environment, and innovation.

- http://www.carbone4.com/wp-content/uploads/2021/02/Road-transportation-what-alternative-motorisations-are-suitable-for-the-climate-Carbone-4.pdf

- Monica Araya – TED talk: How cities are detoxing transportation

- Did you know for instance that rear-view mirror won the first Indy 500 race in 1911. Ray Harroun who win the race was driving the only one-man car, with all other competitors being two men onboard, one for driving and the other one looking backward and alerting the driver to what was going on behind them.

- Formula E became the world’s first fully electric international single-seater racing series when it launched back in 2014, and while F1 has the richer heritage (it’s been around since 1950), Formula E has grown to become one of the most important racing series in global motorsport.

- Nigel Topping, is the UK Government High Level Climate Action Champion for UN climate talks for the COP26

Sources:

BBC - Electric cars: Is it time to buy one? https://www.bbc.com/news/av/world-48108627

Outrage and Optimism Podcast – The future of fuels

Outrage and Optimism Podcast – The race to zero! Extreme electrification with Nico Rosberg and Sara Price

Wikipedia – Phase-out of fossil fuel vehicles

The differences between Formula E and Formula 1 by Rob Watts, February 2020

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’ wealth for...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...