Choose Language

November 13, 2023

NewsUS consumer sentiment slips amid Middle East tensions and inflation worries

The usual weekly newsletter had already “gone to print” last Friday before the release of the University of Michigan’s US consumer sentiment index, so a short update...

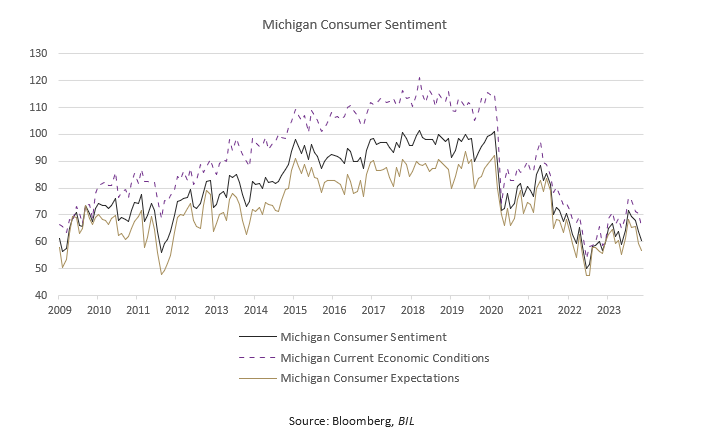

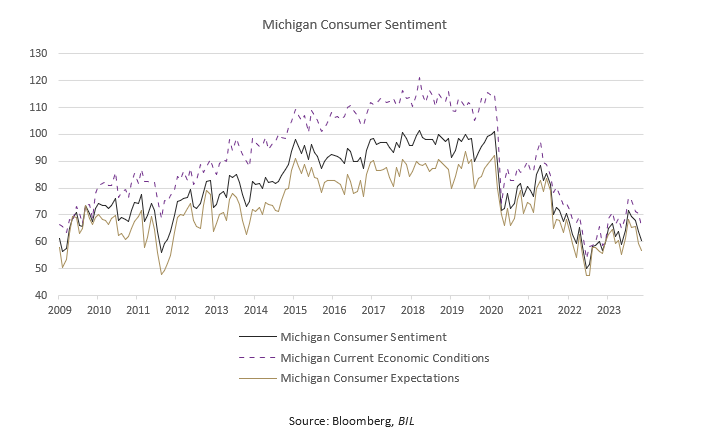

The Michigan Consumer Sentiment survey showed Americans becoming more pessimistic through November, with the headline (represented by the black line) falling to its lowest level in 6 months (60.4, versus estimates of 63.7). As illustrated below, it was dragged down by both perceptions of current economic conditions (65.7 from 70.6), and future expectations (56.9 from 59.3), with geopolitics and inflation playing on consumers’ minds.

However, the devil is in the details and there are two attention points worth highlighting:

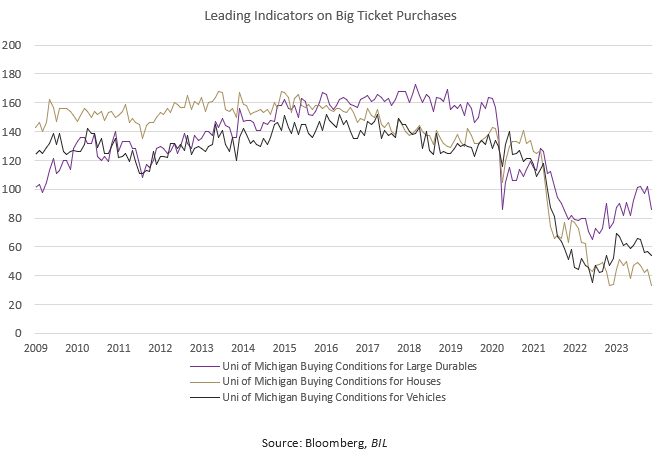

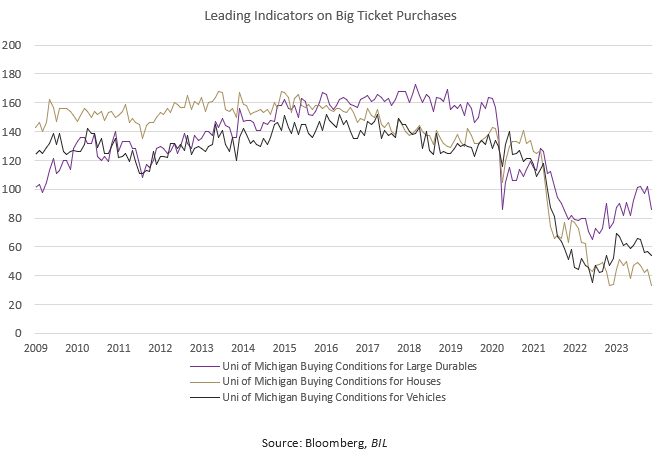

- A subindex showed the propensity to spend on large durable goods (purple line) declined amid higher borrowing costs and tighter lending conditions.

Until now, strong consumption has been the primary rebuttal against recession concerns. However, back in June of this year, Bloomberg Economics conducted a study of household consumption patterns during the recessions that began in 1969, 1973, 1980, 1990, 2001 and 2007. They found that broadly, consumption contains no signalling value for predicting recessions — rather, spending slows moderately only when a recession is already underway. Services spending (about 65% of the consumption basket) is often insensitive to recessions: In all six recessions studied, services spending grew robustly ahead of the recession and in half of the cases, continued to grow even during the recession.

Interestingly, the same study also found that one category had some signalling value – spending on durable goods (which accounts for about 12-13% of the consumption basket). In three of the recessions studied, real purchases of durable goods began to drop in the two or three quarters before recession.

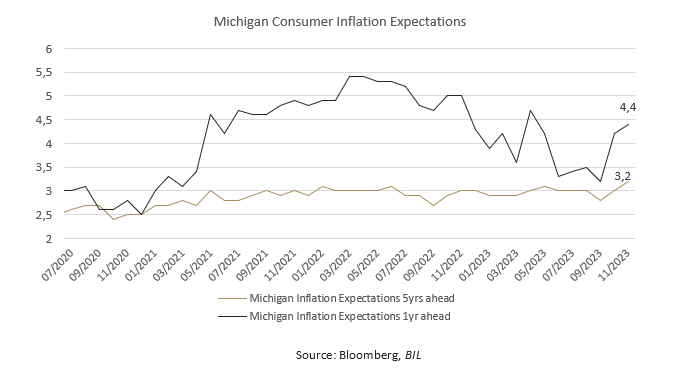

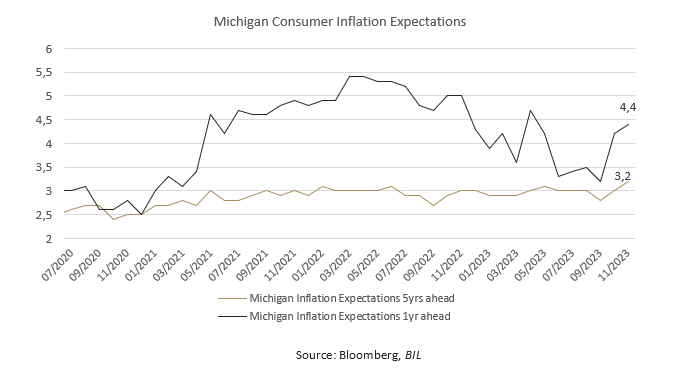

2. Inflation expectations came in above expectations, adding weight to the Fed’s recent communication that inflation has "a long way to go" to reach the Fed's long-term goal of 2%

- 1-year ahead inflation expectations rose to 4.4%, the highest level since April.

- 5-year ahead expectations rose to 3.2%, the highest level since March 2011.

This no doubt adds another worry line to already-crowded foreheads at the Fed, suggesting vigilance is required in that inflation expectations could still become de-anchored.

But with that said, it should be read as a “to note” rather than a crimson red flag. The price perceptions were no doubt influenced by the current geopolitical situation in the Middle East and the potential impact on oil prices. Often, the flash Michigan reading is subsequently revised, and we might see inflation expectations come down in response to the softer energy prices we have seen in recent days in the final print for November (due Wednesday 22nd).

Overall, the weak Michigan reading does not bode well for the prospect of continued strength in consumer spending and economic growth.

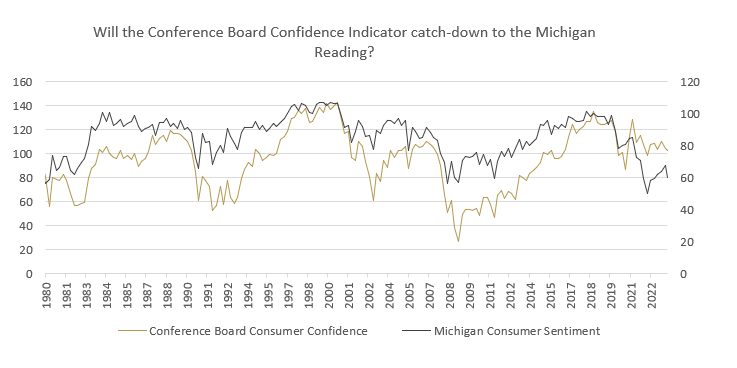

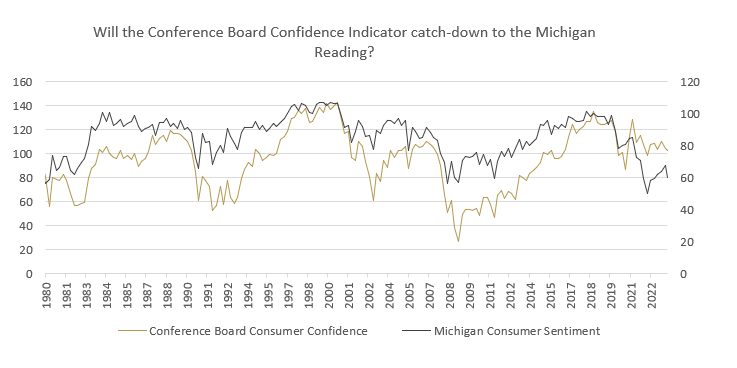

However, it is true that the survey, which is designed to gauge US consumers’ attitudes towards their immediate personal circumstances can be subject to noise (for example, it can be influenced by political attitudes towards the current administration or equity market returns).

Therefore, it helps to take the data in hand with the results of the Conference Board (CB) Consumer Confidence survey, which reflects consumers’ attitudes towards the overall economy more generally (due 28th November).

Until now, the CB index has held up a bit better than its counterpart. If it starts to really “catch-down”, then this would be another red flag for recession.

Source: Bloomberg, BIL

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

BILBoard January 2025 – Snakes ...

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that...

January 13, 2025

Weekly InsightsWeekly Investment Insights

Looking back on 2024, it was a year marked by conflict and political uncertainty, but it also saw major advances in space exploration, the...

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...