The colour

purple, a mix of Republican red, and Democratic blue, the colour that could

herald yet more gridlock on Capitol Hill when it comes to important issues such

as fiscal stimulus, a colour that markets are increasingly apprehensive about. The

US elections are now only a fortnight away and 12 million Americans have

already voted. While focus falls on whether Trump or Biden will take the Oval

Office, the composition of Congress is of even greater significance: Regardless

of who is President, there are three degrees of separation between that

candidate’s agenda and the implementation of said agenda.

As it

stands, the Republicans hold the White House and the Senate, while the

Democrats have a majority in the House of Representatives. Bickering between

the reds and the blues has stalled the roll-out of a second, much needed fiscal

stimulus in response to the pandemic, leaving millions of American households

and businesses dangling over the edge of an income cliff, risking long-term,

structural damage. The Democrats are calling for a huge relief package, worth

at least $2.2 trillion and continue to block Republican proposals (most

recently $1.8 trillion) which they view as insufficient.

While a

divided government is often praised for encouraging

more policing of those in power by the opposition, the pandemic has underlined that with such extreme political polarisation in

the US, it can also create legislative gridlock, affecting the efficiency of

the government which in this case is hampering the economic recovery. This is

one of the underlying reasons why markets were surprisingly bullish about Biden’s widening lead in polls and about the growing prospect of a

“Blue Wave”.

What is a blue wave?

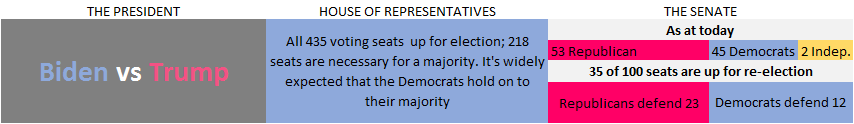

A blue wave refers to a Democratic sweep in which they take control of all three branches of government. Already, the Democrats control the House and it is widely expect that they will hold on to this. Since the presidential debate on September 29th, polls show increased likelihood not only of a Biden presidency, but of a Democrat majority in the Senate. If the polls are wrong and the Republicans keep a majority in the Senate, they will be able to obstruct certain elements of the Democratic agenda, in the event that the White House is lost. If the Republicans keep the White House and the Senate, we can expect more of the same.

The blue skies that markets envisage…

Since polls

revealed an increased likelihood of a blue wave, markets have risen, notably

cyclicals and small-caps which lagged bigger names in the ascent that began in

March.

The

market’s reaction to polls has indeed been contrary to traditional intuition: Democratic

policies (higher taxes[1],

higher public spending and more regulation) have typically been perceived as

“bad for business”, while “Trumponomics” have been very

supportive of stock markets; Trump was quick to slide the knife through

corporate tax rates (decreasing them from 35% to c.21%) and he has presided

over an equity market that skipped from new high to new high, as well as a

50-year low in the unemployment rate.

However,

markets now seem to favour the outcome that is most likely to give the

stimulus-thirsty economy what it needs, ASAP. A blue wave would make it easier

for the Democrats to roll-out a significant fiscal stimulus plan. While giving

up any vestige of fiscal conservatism sounds scary over the longer term, it

seems that for the meantime, investors are consoled by Fed Chair Jerome

Powell’s recent pledge to work “side by

side” with Congress (code for “you have our balance sheet for your financing

needs”?). It could also be perceived that by not doing enough now is scarier, as

it could leave lasting economic scars that take years to heal.

If the Senate remains in Republican hands

or if there is a Trump victory combined with a divided Congress, further delays

with regard to stimulus might be expected. In turn, this could be detrimental

to the economy and markets will be continue to tank and crest on discussions

around the timing, shape and size of a support package.

Foreign

Policy

There is another reason why a blue victory

may be welcomed by markets… When it comes to foreign policy, Biden may adopt a

less bellicose rhetoric, especially on trade. In 2019, the US-China trade war

was a major headwind for global growth and before the coronavirus pandemic

stole the show, markets were held hostage to US trade policy (often

communicated bluntly via the Trump Twitter feed), resulting in elevated

volatility. While frictions with China – especially with regard to technology

and intellectual property – are unlikely to go away (opinion polls show that

both Republican and Democratic voters support a tough stance on China), it is

expected that Biden would adopt a less impulsive communication policy.

Sector

Impacts

While the market as a whole is warming to

the idea of a blue wave, the election outcome will have varying implications

for different sectors and areas of the economy. Initially, a Republican stronghold

should support corporate confidence (no risk of higher taxes) and increase their

propensity to resume investment. Democrat success should foster wealth

redistribution (e.g. Biden supports a $15 minimum wage), supporting consumption

at the lower end of the income spectrum

The sectors that are likely to benefit the most from a blue wave are utilities, consumer staples and materials. Contrasting with Trump who withdrew the US from the Paris Climate Accord, a central tenet of Biden’s campaign has been based on greening the economy and achieving carbon neutrality by 2050. This could be a catalyst to unlock significant capex opportunities towards renewables and carbon capture. Just on the anticipation of a blue wave, “green stocks” have rallied in the past weeks. The aforementioned sectors are likely to be key beneficiaries of any switch towards decarbonization.

On the same note, the Energy sector faces prominent headline risk around the election. The medium to longer-term implications from an administration focused on decarbonisation (vs. the status quo) are significant while a Biden win could also mean stringent regulations on fracking.

The outcome for financial stocks is more difficult to ascertain. Wall Street has enjoyed halcyon days with Trump in the Oval Office and tighter regulations under the Democrats could be challenging. However, price movements in recent weeks suggest that market participants potentially think the benefits of stimulus-induced economic growth from a Biden win would outweigh the costs of a stricter regulatory regime.

Health Care is traditionally the first sector on investor minds when discussing political repercussions. From the Democrats, Biden campaigned against Medicare for All, but an extension of the Affordable Care Act (aka Obamacare) or Medicare to particular segments of the population could be expected with a potential impact on Healthcare Services companies. For pharmaceutical companies, the political rhetoric related to drug pricing will probably be less relevant in the current context and for as long as the majority of the population is not vaccinated against Covid-19. MedTech remains largely insulated to regulatory and pricing risk via-a-vis the broader sector.

Information technology is exposed to headline risk on Big Tech regulation and breakups from both parties. Criticism around privacy, misinformation and monopolistic behavior is abound on both sides of the Atlantic, while tighter regulation on China could impact hardware supply chains. But ultimately, those firms involved in the advent of the Fourth Industrial revolution and digitalisation are likely to be relatively unaffected by the political backdrop.

Bottom-line, at least we can agree that a

blue wave will be green and that ongoing structural trends will persist.

But

what about the greenback?

The composition of government, however the

chips may fall, will have a blend of pros and cons for the dollar.

What we should remember is that while the stars were aligned for a stronger dollar prior to the crisis, it simply did not happen. Policies unveiled during Trump’s tenure such as tax cuts, those that encourage the repatriation of overseas earnings and deregulation of many industries were all dollar-friendly. A blue wave and the reversal of some of these policies could indeed bring about a weaker dollar. Moreover, the resulting twin deficits risks from higher spending risks eroding the dollar’s credibility. If the Republicans hold onto the Senate, they will still be able to constrain spending to some extent.

Conclusion

The fulcrum of investor sentiment seems to have become fiscal stimulus. Cognizant of this, there is always the chance that Trump waits until the last minute to unveil his own large-scale stimulus plan. While it has not been forthcoming, he recently tweeted “STIMULUS! Go big or go home!!!”.

Readers are reminded that we have no magic 8 ball – polls and prediction markets have little success when it comes to divining the outcome of elections. This is especially so in the US where the Electoral College[2] system means that Presidents are not elected on overall popularity. The election result could still swing either way. Let’s stay humble, market prognosticators are notoriously bad at this stuff even if the sell-side industry is full of convictions about how the November 3rd vote will spur regime shifts in financial markets. The consolation is that a well-diversified portfolio and robust investment strategy should better navigate short term financial market turbulence, regardless of a red, blue or purple outcome.

[1] Biden’s proposed tax plan involves a partial reversal of the 2017 Trump tax cuts, from 21% to 28% and a new minimum corporate tax rate of 15%. Source: https://taxfoundation.org/joe-biden-tax-plan-2020/

[2] To

win the election, a candidate must receive a majority of electoral votes from

the Electoral College. The Electoral College consists of 538 electors, and an

absolute majority of at least 270 electoral votes is required to win the

election.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 19, 2025

Weekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...