Choose Language

April 28, 2023

NewsUS GDP Growth: Q1 2023

The US economy slowed sharply in the first quarter of 2023 as the Federal Reserve pushed ahead with its historic monetary tightening campaign.

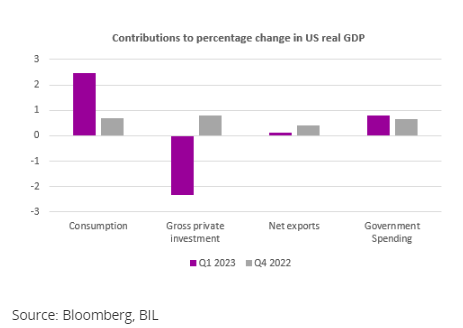

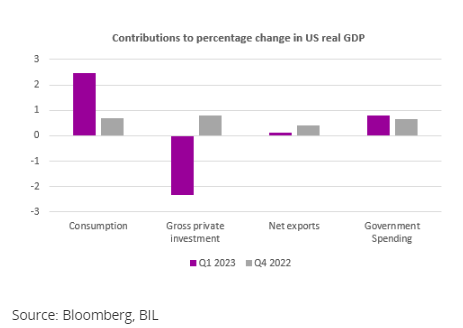

Preliminary data released today, showed that the world’s largest economy grew by 1.1% on an annualised basis in the first quarter. This marks a pronounced deceleration from the 2.6% growth registered in Q4 2022. It is also well below economists’ expectations for a 2% increase.

The key detractor was gross private domestic investment, with inventories shaving off 2.26 percentage points from the growth rate as the stockpile of unsold goods grew at a much slower pace. Also within this category, residential investment weighed on growth for the eighth month in a row. However, with the housing sector being one of the first victims of higher rates, it might now be bottoming out and the drag on growth is becoming less pronounced. It is also worth noting that businesses cut back on equipment spending as pressure starts to build on corporate profit margins.

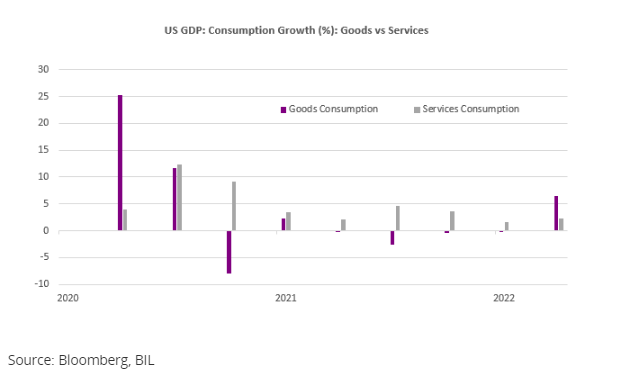

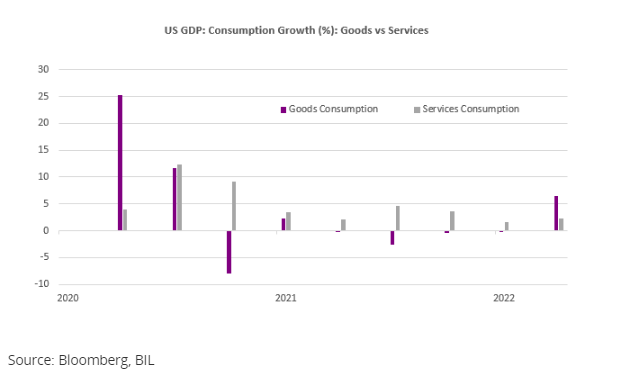

Consumption, the growth engine of the United States economy, showed enduring strength, adding 2.5 ppts to GDP, its biggest contribution since the second quarter of 2021. Interestingly, Americans returned to purchasing goods (especially motor vehicles and parts – perhaps a last burst of pent-up demand as chip shortages and other supply constraints eased, allowing new car production to resume pace, and ultimately prices for new and used cars to retreat). Service consumption also remained strong, especially on healthcare. Moving forward, sentiment indicators suggest that consumer demand is set to soften.

Government spending brought its biggest contribution to GDP in two years -- more than half of that came at the federal level. Defense spending in particular provided a notable bump, making up 0.21pp of the annualised growth rate.

While growth turned lower, inflation pushed higher with the first look at Core PCE prices rising to 4.9% compared to a forecast of 4.7% and 4.4% in the prior quarter.

With the inflation battle not yet over, the Fed is expected to announce another 25bp rate hike next week, which would bring the federal funds rate to a new target range of 5 to 5.25%, before considering a pause in its hiking cycle (especially given that the red-hot labour market is finally shows signs of cooling). A hiatus from June would allow policymakers to assess the impact of their actions over the past year as well as take the pulse on liquidity following the recent turmoil affecting small-to-mid-sized banks.

While allowing inflation to become entrenched is clearly the biggest risk, policymakers also have to take care not to overtighten, an eventuality that would likely lead to a "hard landing" for the economy (a sharp contraction and a spike in unemployment).

Authors

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...