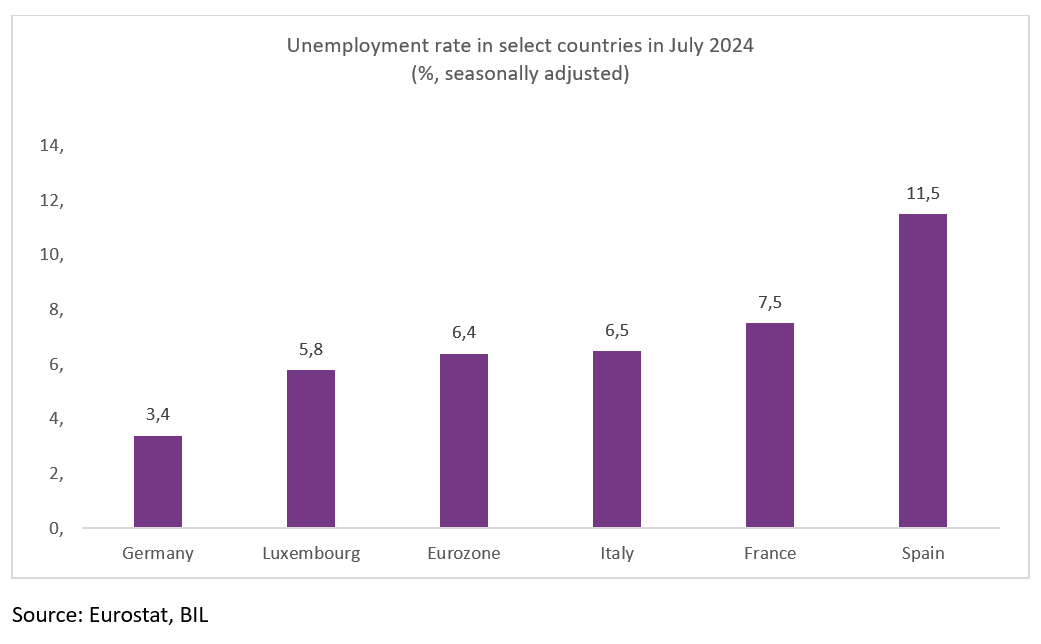

At 6.4%, the Eurozone unemployment rate currently sits at its all-time low, but the picture varies from country to country. Labour market trends will influence the pace of the ECB's rate cutting campaign to support the Eurozone economy. We take the pulse of the dynamics in some of the bloc’s main economies and see how Luxembourg’s compares.

In July, the Eurozone unemployment rate fell back to a record low of 6.4%, down from 6.5% in June. This is somewhat surprising given meagre growth, weak demand and a period of tight monetary policy aimed at cooling inflation. While demographics are causing structural tightness, on a more cyclical basis, the low unemployment rate is partly due to the fact that companies have been hoarding workers in the hope that demand will soon rebound.

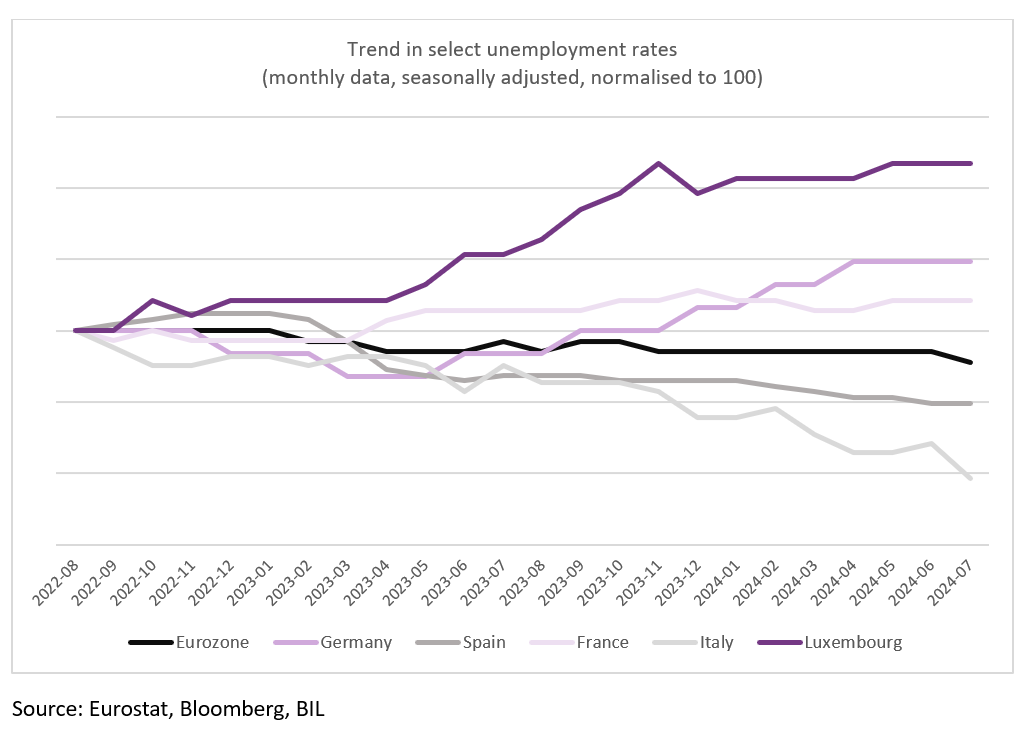

ECB policymakers have, on several occasions, noted the risk that a “surprisingly strong” labour market pushes up wage growth. Complicating matters for the ECB, is the fact that the situation is not harmonious across Eurozone states. As the below chart shows, some countries have enjoyed a downward trend in unemployment over the past two years, while some have seen the opposite, quite notably Luxembourg.

Readers should note that Luxembourg’s unemployment rate has trended up relative to its own history but is still below that of other countries as shown in the second chart below.

A quick read of the Eurozone data

If we make broad generalisations, we can say economies that are more services-oriented (especially those with burgeoning tourism industries), are seeing unemployment move in the right direction. In Italy and Spain, for example, unemployment rates have fallen to levels unseen since 2008. Germany, on the other hand, is seeing unemployment tick up amid ongoing malaise in industry (which accounts for almost one quarter of overall GDP). The unemployment rate is still low overall, however, and Germany’s trade unions continue to push for higher pay. This year, the country is expected to see one of the fastest paces of real income growth since 2000 as workers try to regain the purchasing power lost in the aftermath of the pandemic. In France, the unemployment rate sits at 7.4% today, versus 7.2% in August 2022. Labour reforms put in place by Macron, aimed at achieving full employment by 2027, have made it easier for companies to negotiate salaries and wages directly with employees, without the need for trade unions and collective deals impacting entire sectors. They have also attempted to make it easier for companies to hire and fire workers.

A closer look at Luxembourg

Luxembourg’s economy is predominantly services-oriented but the sector has been hit with idiosyncratic issues.

Looking at the facts, as at the end of July, the number of resident jobseekers registered with ADEM stood at 17,901, representing an increase of 11.1% from July 2023. The most highly qualified jobseekers (higher education graduates) saw the biggest increases. Over the same period of time, job vacancies dropped by 20.8%, bringing the total to 7,539.

Many positions remain unfilled due to mismatches in skill sets, particularly in areas such as language proficiency. By sector, ‘professional, scientific, and technical services’ is most affected by labour shortages. On this front, efforts are now being made to attract more non-EU experts in “highly-skilled occupations considered to be in short supply”.[1]

Digging into the data, it is clear that the decline in vacancies and the rise in jobseekers can, to a large extent, be traced back to the ongoing real estate downturn and restructuring in financial services.

Luxembourg’s real estate sector was one of the first to be impacted by higher interest rates. To illustrate the extent of the downturn, at the end of last year, transactions for apartments fell to the lowest level seen in any quarter since the Land Registry was created in 2007. This has had clear downstream effects across a range of professions, from real estate brokerage to promotion to construction to installation.

The financial sector accounts for 25% of the country's GDP. Over the past years, amid a more challenging macroeconomic context, various banks and financial institutions have restructured or refocused their operations. Digitalisation is also becoming more pertinent. Mechanically, a reduction in workforce in Luxembourg has a bigger impact on the overall unemployment rate due to the country’s size. If 200 workers suddenly become unemployed tomorrow in the Grand Duchy, the total number of jobseekers would hypothetically rise 1.12% to 18,101. If a bank in Germany laid off the same amount of people, the impact on the unemployment rate would be a drop in the ocean given that there, 2.6 million people are registered as unemployed.

What next for the Luxembourg labour market?

Looking ahead, the Chamber of Commerce’ latest Barometer of the Economy, published in June 2024, found that despite the difficult economic climate, 65% of companies plan to keep their workforce stable over the next six months. 17% of companies are planning to reduce their workforce, while 18% are planning to increase it, pointing to sluggish job creation ahead. Employment prospects differ significantly between sectors. Those in industry, construction and commerce are more inclined to forecast a decline in staff numbers (29%, 27% and 22%, respectively) than increases (12%, 10% and 14%). On the other hand, the financial and non-financial services sectors are more optimistic, with 23% and 22% of companies anticipating an increase in their workforce, compared to just 8% and 12% forecasting a reduction.

Overall, the European Commission expects the Luxembourgish unemployment rate to level off at 5.8% this year, before declining slightly to 5.7% in 2025.

Lower interest rates will certainly help. With interest rate differentials in mind, the fact that the Fed has signalled it is ready to begin cutting rates is good news as the ECB is now more free to continue with its own rate cutting campaign to support the Eurozone economy. If the Fed had remained on hold, further easing by the ECB would likely weaken the euro, which in turn could rekindle inflation in the bloc.

[1] https://www.luxembourgforfinance.com/en/news/easier-and-faster-access-to-employment-for-non-eu-nationals/

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...