- Written 13th May 2022

2022 was to be a year of strong economic growth. Supply chain disruptions would ameliorate. Consumers with unusually high savings rates would get busy addressing pent-up demand. Corporate profits would swell… Mid-May, this narrative is fast-deteriorating. Inflation sits stubbornly at multi-decade highs, geopolitical issues in Europe threaten the supply of essential raw materials, and risks to growth are rising as we stare down the barrel of tighter monetary policy hoping that central banks can orchestrate a soft landing for their respective economies.

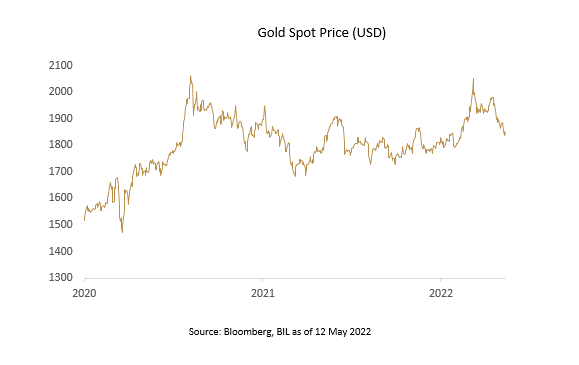

In such a context, equities and bonds alike have undergone intense selling pressure. Simultaneously, the price of gold – typically considered a safe haven in times of turbulence and a hedge against inflation - retreated back to levels seen before the conflict in Ukraine, leaving some investors perplexed.

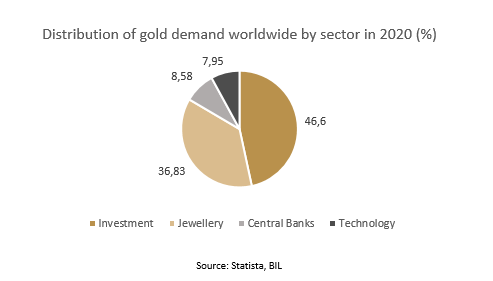

To analyze movements in the gold price, it is first important to understand that given its limited use in industry, gold’s value is largely driven by economic sentiment and the ebb and flow of demand. This of course means its price can be volatile.

Broadly speaking, demand for gold tends to rise in times of stress or high uncertainty as investors exit riskier assets and seek out safer places to park their cash. Conversely, in times of relative calm when the economy is faring well, riskier assets like equities might outshine gold in terms of return potential. Gold demand also typically piques when inflation expectations are on an upward trajectory, with investors seeking protection from its corrosive effects on the value of fiat currencies or on bond coupons.

In today’s context, we may therefore question why gold has not rallied more, given heightened geopolitical risk and the fact that inflation is about four times central bank targets in both the US and the Eurozone.

What is key to keep in mind is that real rates are negatively correlated with gold. As central banks embark on policy normalization, inflation-adjusted yields on other “safer” assets like core Government bonds which were paltry or even negative at the beginning of the year, are becoming more attractive. This dims the shine of gold in a portfolio because bullion offers neither interest payments nor dividends.

The price of gold is also tied to the US dollar index, as it is a USD-dominated asset class. When the dollar rises (as it has been doing so lately against the backdrop of a more hawkish Fed), gold becomes more expensive in other currencies, which in turn, takes a toll on demand.

However, there may be another factor at play currently weighing on the gold price… an ongoing squeeze on leveraged investors. At the onset of the pandemic in March 2020, as is seen on the chart, gold registered a sharp decline, which again was surprising given that global capital markets were in disarray and the world was thrust into a state of panic. In retrospect, some analysts believe that the flight to safety was temporarily interrupted as gold fell victim to its status as a liquid asset: Investors facing margin calls in other asset classes were forced to sell their gold positions to cover them. It wasn’t until the Fed began pumping liquidity into the market that the gold price rebounded. A similar pattern played out following the crash of Lehman in 2008 that led to the global financial crisis: Gold initially slumped, viewed by investors as a rich source of cash, before going on to enter a multiyear bull market.

With the ongoing market turmoil, corroborated by a bloodbath in the cryptocurrency market, there is a chance that behind the scenes, the same is currently happening today. The key difference is that the Fed is firmly committed to a tightening cycle as it battles to prevent inflation from spiralling.

For investors, while gold boasts important functions as both a store of value and a diversifier, today’s price action highlights an important point: short-term price movements are often frustratingly difficult to predict and impacted by a confluence of factors, some more obvious than others.

Gold’s glitter really starts to become apparent when considered over a long-term investment horizon and when it is included inside a well-diversified multi-asset portfolio.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...

January 19, 2026

Weekly InsightsWeekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...

January 9, 2026

Weekly InsightsWeekly Investment Insights

Safe haven assets, including gold, rose at the start of the week in response to the US intervention in Venezuela which sparked questions about the...